The Swiss pension system is based on three pillars. There is a state, an occupational and a private pension plan. In this article we explain how the individual pension schemes work and how they complement each other.

The 1st pillar: AHV – the state pension

Old-age and survivors’ insurance (OASI = German AHV) is the first pillar of the Swiss three-pillar system. The aim of the first pillar is to cover subsistence needs in old age or in the event of death (orphans’ and widows’ pensions). If the AHV pension is not sufficient to cover the minimum living costs, supplementary benefits can be applied for. Supplementary benefits are financed jointly by the confederation and the cantons. No wage contributions may be levied to finance supplementary benefits.

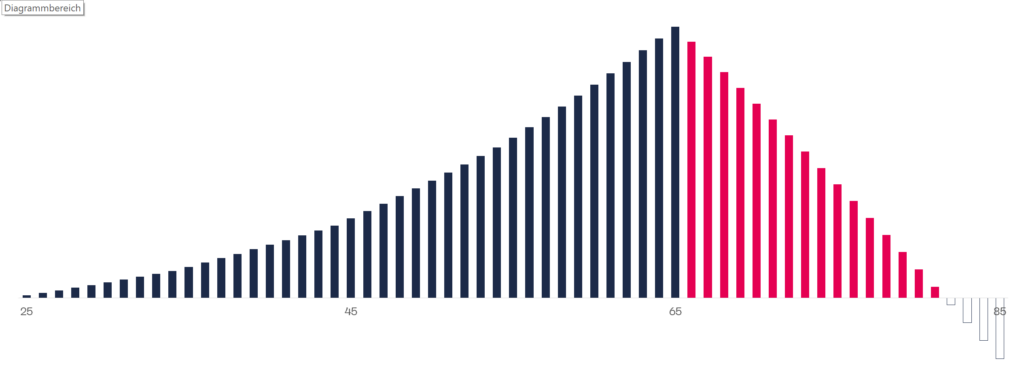

The AHV operates on the pay-as-you-go principle. The employees finance the pensions with their contributions. The working population provides for those who have retired. It is also known as an inter-generational contract: the generation that makes contributions today is dependent in future on the next generation doing the same. Since the intergenerational contract is an imaginary construct, discussions are constantly sparked off as to whether the next generation will still be able to finance the growing number of pensioners.

Employers and employees finance the AHV contributions on a solidarity basis. Both pay 4.2 % of their gross wages. In addition, there are also contributions to disability insurance (IV) and income compensation (EO). AHV, IV and EO together result in a wage deduction of 5.125 %. The employer regularly transfers the contributions to the cantonal Ausgleichskasse, the industry Ausgleichskasse or the association Ausgleichskasse. If you have any doubts about your employer’s creditworthiness, you can ask the compensation fund whether the contributions have been transferred.

AHV, IV and EO contributions are paid on the entire income. There is no upper limit. The benefits, however, are limited. In the case of the AHV pension, they amount to a minimum of CHF 1’225 and a maximum of CHF 2’450 per month for single people. Married people receive a combined pension of between 2’450 and 3’675 francs per month. The AHV retirement pension must be applied for. If you want to know how much the pension will be, you can ask the Ausgleichskasse for an advance calculation.

The second pillar: OASI – the occupational benefit plan

BVG is the abbreviation for the german term “Berufliche Alters-, Hinterlassenen- und Invalidenvorsorge-Gesetz” (Englisch OASI). Occupational pension schemes supplement the AHV. Together, the AHV and the pension fund (BVG) are intended to enable the insured person to continue his or her accustomed standard of living after retirement (pension of 60% of the last insured salary).

The occupational pension scheme operates on a defined contibution system. Everyone saves their own retirement assets during their working life. On retirement, the retirement assets are converted into a life-long pension. The conversion rate is at least 6.8 percent for the mandatory portion. A retirement savings capital of CHF 100’000 results in an annual pension of CHF 6’800*.

Due to the increased life expectancy, the accumulated old-age savings are no longer sufficient to finance pensions until the end of life. The active insured finance this deficit. Their retirement savings are not credited with the entire yield earned. Part of the return on the retirement capital is used to cover the pension deficit. There is a redistribution from the working population to the pensioners. Read more about this in a commentary on the current proposals for the reform of the 2nd pillar.

* At least a quarter of the retirement assets can be withdrawn in the form of a lump sum at the time of retirement, or more if your pension fund allows more.

Most SMEs in Switzerland are affiliated to collective and joint institutions. Larger companies with several hundred employees sometimes have their own pension schemes. In both cases, the pension protection is provided by a foundation. The foundation defines the pension plan, how high the contributions and benefits are. The pension plan must be within the legal guidelines. The parameters defined by law (e.g. contributions, interest, conversion rate) are to be understood as minimum requirements. Pension schemes may provide higher benefits as long as they remain appropriate.

The 3rd pillar: 3a – private provision

Pension provision with the restricted form of the third pillar (3a) is voluntary. You decide for yourself whether you wish to build up a third pillar in addition to the 1st and 2nd pillar. Every two years, the Federal Council determines the maximum contribution you can pay in and thus also deduct from your tax bill.

Viele Vorteile sprechen fürs freiwillige Sparen mit der Säule 3a:

- You can deduct the payments from taxable income

- You do not have to tax the income on your 3a assets as income. The retirement assets are also not taxable (no wealth tax).

- You can decide how much you want to deposit and how you want to invest the money. However, if you implement the 3rd pillar in the form of an insurance policy, you may be bound by the annual payments.

- You can withdraw the money in pillar 3a in advance if you want to buy your own home, become self-employed or if you are emigrating.

It pays to start building a 3rd pillar as early as possible, especially if you invest your 3a money in securities. Although there will certainly be one or two economic crises between now and retirement, you can look past them with confidence thanks to the long investment horizon. Experience shows that the stock markets recover after a crisis.

If you want to use 3a funds to buy your own home, there is the alternative of pledging. Your 3a assets remain invested. In addition, unlike a lump-sum withdrawal, you do not have to pay taxes.

A distinction is made between pillar 3a and pillar 3b, which refers to free saving. Payments into the pillar 3b (e.g. into a savings account) are not tax-deductible.