Redistribution

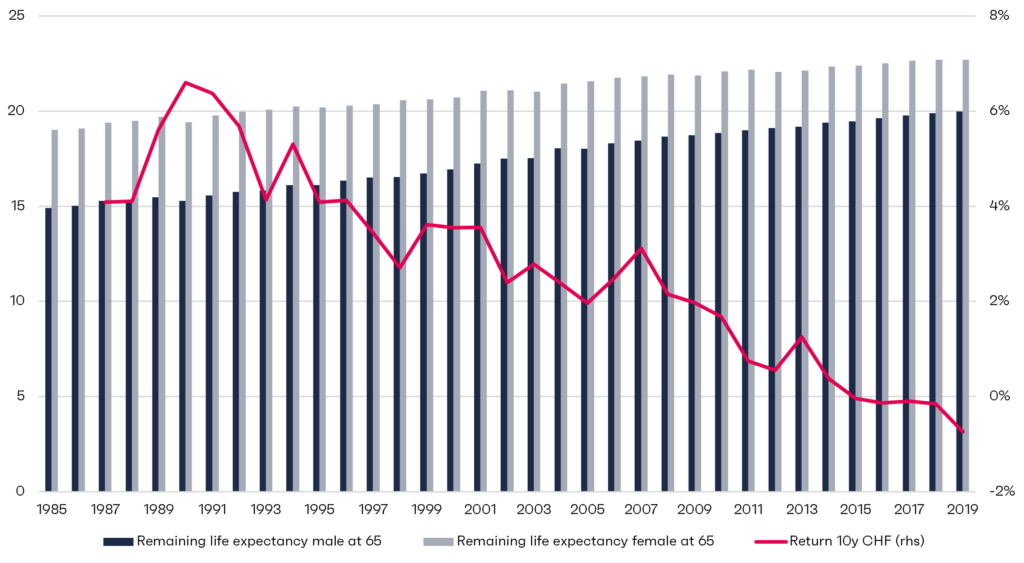

In occupational pension plans, a distinction is made between the mandatory and the supplementary benefits. In the mandatory scheme, the savings contributions and also the benefits are set at a minimum. As returns on capital markets have fallen and life expectancy has risen while retirement age has remained the same (see diagram), the retirement assets are no longer sufficient to finance pensions. This results in conversion losses.

These conversion losses are financed by redistribution from active insured to pensioners by:

- the retirement assets are not credited with the entire return generated by the pension fund on the capital markets (frequently) and

- the conversion rate in the supplementary obligation is reduced excessively to compensate for the losses in the BVG obligation (less frequently).

According to figures from PPCmetrics, over 90 billion have been redistributed from workers to retirees in the past ten years (2009-2018).