Benefits

Within the framework of vested benefits, you can decide for yourself how your assets from second pillar are invested. The securities solution from finpension offers the following advantages:

Cheaper

Better

Higher

More effective

Flat rate fee

The investment strategies offered are implemented with zero-fee funds. The costs for access to these funds are borne by the foundation. They are included in the flat-rate administration fee.

There are no further charges for transaction or custody. To the fee schedule.

No hidden fees

But the low flat-rate fee is not enough. Compared to other providers, you can save even where you might not even notice it. Here are a few examples:

More value

One percent more or less. Who cares about that? But watch out: Over time, a supposedly small difference can make a lot of money. Take a look for yourself:

Bases of calculation:

Investment period 25 years, average annual return of 3.25 %, incl. additional return compared to competitors of 0.75 % due to lower investment costs and withholding tax optimisation.

Strategies

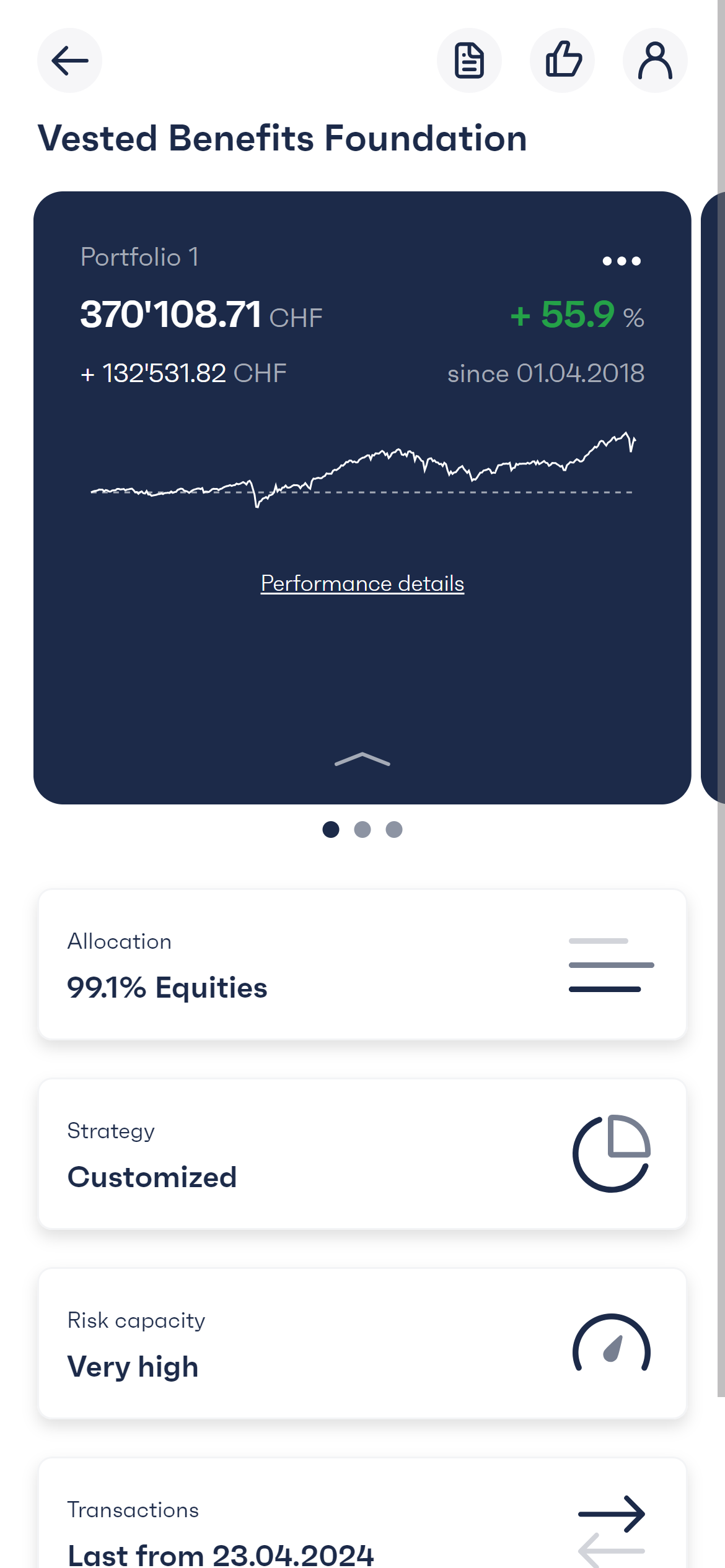

We have put together six investment strategies for you with varying degrees of equity exposure. The strategies are available in three different versions, Global, Switzerland and Sustainable. Each strategy can be adapted individually. You decide. But don’t worry, we will help you.

Since you can invest in the zero-free fund classes with finpension, the average costs of the funds (TER) used are close to 0.00 %.

Fund house

Your strategy is implemented with the zero-free funds of Credit Suisse, Swisscanto or UBS.

The fund houses are all on a par. None is superior to the other. Choose one of the fund houses according to your preference, or combine the funds as you wish with an individual strategy.

Swisscanto

Your strategy is implemented with Swisscanto’s index funds. Swisscanto is owned by Zürcher Kantonalbank.

UBS

Your strategy is implemented with the UBS index funds.

ex Credit Suisse

Your strategy is implemented with the Credit Suisse Index Funds (CSIF).

Register now

You can register directly via our web app or by downloading the finpension app on your smartphone. Have your health insurance card ready, because the AHV number is on it, which will be requested during registration.

- Download and registration are free of charge and there is no minimum fee.

- There is no obligation to transfer vested benefits and there is no minimum contract period.

- You only pay from the moment your first vested benefit credits is received.

- Transfers of existing vested benefits are of course possible at any time. You will receive a transfer form as soon as you have registered.

- For each successful referral, you will receive a fee credit of 25 Swiss francs.