This article is written for people who have invested their Pillar 3a in equity funds. In contrast to the 3a account, the value of 3a funds fluctuates, which is why the question arises as to whether it is worth trying to find the right entry point.

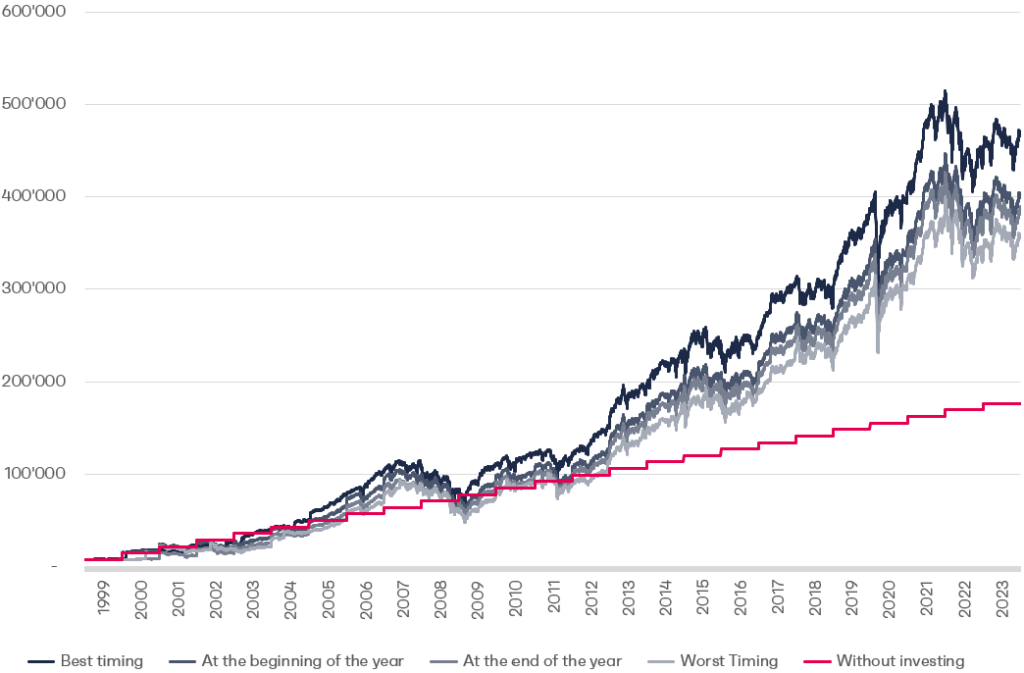

We put it to the test. Using the Swiss SPI share index, we analysed how performance has developed over the last 25 years. We invested the maximum amount (2024) year after year, choosing four different investment dates:

- Always at the best time (lowest stock market level)

- Always at the beginning of the year

- Always at the end of the year

- Always at the worst time (highest stock market level)

What does the evaluation want to tell us?

The evaluation of the results of our analysis shows that it does not make much difference when one pays into the pillar 3a. Much more important than the time of investment is that one pays into the pillar 3a at all and invests the money.

But, if you have the financial opportunity, you should always invest in pillar 3a at the beginning of the year. Of course, you can always try to find the right time to invest. However, there is a high probability that you will not find it. Then you will do worse than at the beginning of the year.

| Best time | Beginning of the year | End of the year | Worst time | |

| Accumulated deposits in CHF | 176’400 | 176’400 | 176’400 | 176’400 |

| Final value in CHF | 468’339 | 400’875 | 388’501 | 357’357 |

| Accumulated performance in CHF | 291’939 | 224’745 | 212’101 | 180’957 |

| Performance Total | 165% | 127% | 120% | 103% |

| Annualised Performance per annum | 4.0% | 3.3% | 3.2% | 2.9% |

Also, if you look at the effective performance, you see that it doesn’t depend so much on the timing of the investment, but much more on the fact that you invest at all.

Set up a monthly standing order for pillar 3a

Also a good idea is to set up a standing order at the beginning of the year that pays a certain amount into your Pillar 3a each month. This approach can simplify your budget planning, as you do not have to put the amount for pillar 3a aside.