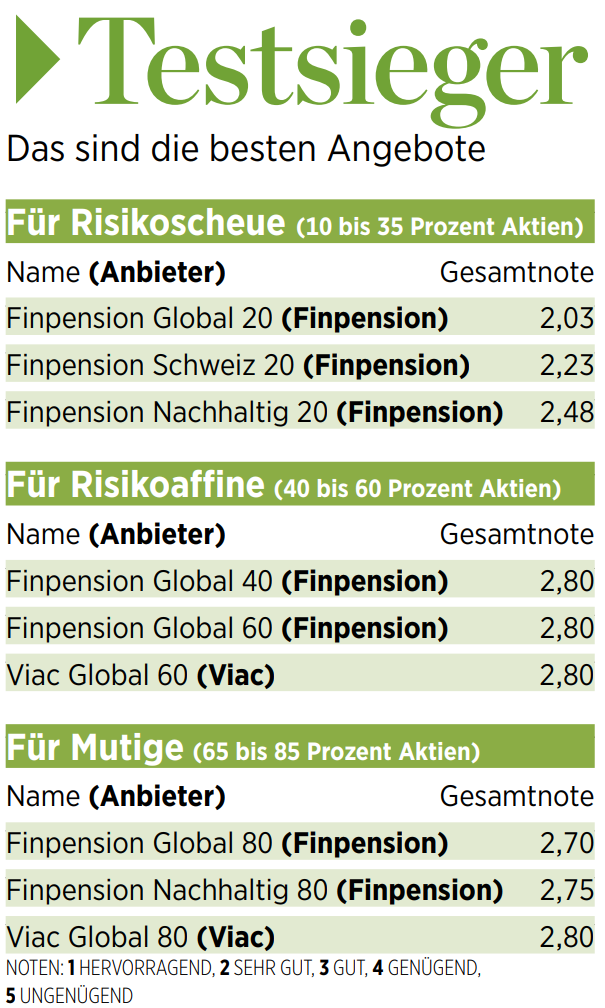

The Handelszeitung (German only) has compared pillar 3a funds. The result of the comparison is impressive:

And it is no coincidence that our investment strategies for pillar 3a have performed so well. It can be explained.

Why did our 3a funds perform so well in the comparison?

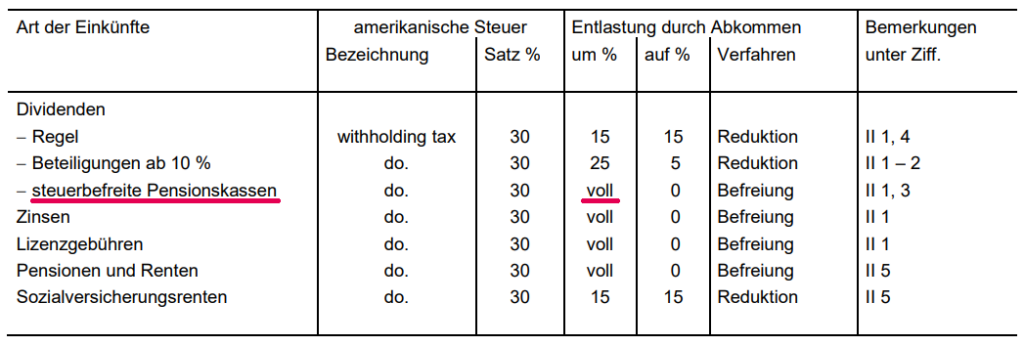

1. Exempt from foreign withholding taxes

We use funds that are only accessible to pension funds and their clients. Because the circle of investors is limited, the funds used can be exempted from withholding tax on foreign income. This is thanks to the better position in the international double taxation agreements, as the example with the USA shows here:

The exemption from withholding taxes on foreign dividends and interest leads to an additional return of up to 0.4 % per year in contrast to funds that are not exempt from withholding taxes.

Since the beginning of June, we have also been the first 3a pension foundation for Japan to invest in the Credit Suisse Pension Fund class. This has resulted in a further performance advantage.

2. Falling interest rates led to a positive return on bonds

Another reason why our 3a strategies have performed better than those of our competitors are bond investments. Although bonds in Swiss francs hardly yield a return any more, internationally there is still a yield to maturity of around one percent per year.

| Fund name | ISIN | Share in % | Yield to maturity p.a. |

| CSIF (CH) Bond Corporate Global ex CHF Blue ZBH | CH0189956813 | 40 | 1.59% |

| CSIF (CH) Bond Switzerland AAA-BBB Blue ZB | CH0039003055 | 30 | -0.11% |

| CSIF (CH) I Bond Government Global ex CHF Blue ZBH | CH0188772989 | 20 | 0.52% |

| CSIF (CH) Bond Government Emerging Markets USD Blue DBH | CH0259132261 | 10 | 4.07% |

| Total weighted yield to maturity | 1.11% |

(Factsheets as at 31 May 2021)

The funds are hedged against currency fluctuations (“H” at the end of the fund name means hedged). As interest rates have continued to fall, it has been possible in the past to achieve a positive return even after currency hedging:

| Fund name | ISIN | Share in % | Return over 5 years |

| CSIF (CH) Bond Corporate Global ex CHF Blue ZBH | CH0189956813 | 40 | 11.85% |

| CSIF (CH) Bond Switzerland AAA-BBB Blue ZB | CH0039003055 | 30 | 1.69% |

| CSIF (CH) I Bond Government Global ex CHF Blue ZBH | CH0188772989 | 20 | 1.63% |

| CSIF (CH) Bond Government Emerging Markets USD Blue DBH | CH0259132261 | 10 | 12.90% |

| Total historical return after currency hedging | 7.94% |

(Factsheets as at 31 May 2021)

3. Advance payment of withholding tax reclaim

The advance payment of the withholding tax recovery from the federal government only indirectly has an advantage over the competition, but it is worth knowing.

The funds used must pay the withholding tax to the federal government annually.

As soon as we receive the statement from our custodian bank, Credit Suisse, we credit the withholding tax to our clients. In the following tax year, we reclaim the withholding tax for our clients in bundled form from the federal government.

This advance payment of withholding taxes has two advantages for our clients:

- The withholding tax is already reinvested on the next trading day.

- Our clients do not miss out on the withholding tax, even if they leave us between the settlement by Credit Suisse and the repayment by the Federal Tax Administration.

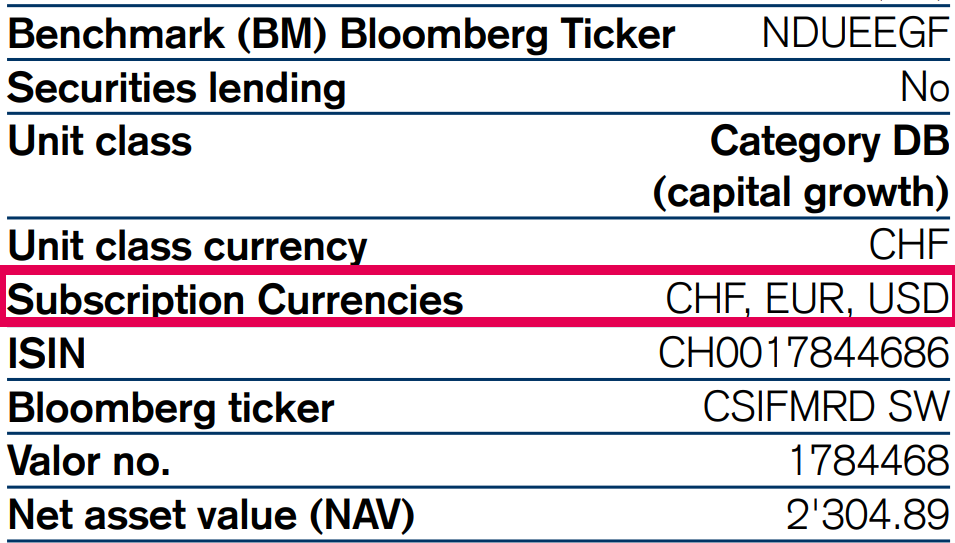

4. No fee on foreign currency exchange

Advantage 4: The funds we use can be subscribed in different currencies:

Unlike competitors, we deliberately invest in the CHF tranches. If necessary, the exchange into another currency within the fund takes place at the mean exchange rate.

This is relevant because the competition is deliberately investing in the foreign currency tranches in order to make some more money on a little-noticed sideline (foreign currency exchange).

The foreign currency fees of the competition were not taken into account in the Handelszeitung comparison. If these had been taken into account, finpension would have done even better.

5. Price leadership for pillar 3a investments in securities

Our 3a securities app is the price leader when it comes to pillar 3a investments in securities. The fee is a flat rate of just 0.39 %.

The funds used belong to the zero-fee class. They have practically no additional costs (TER between 0.00 and 0.03 %). Overall, the costs for the strategies offered are only 0.39 to 0.42 % per year.

This is one of the most important factors why finpension did so well in the Handelszeitung comparison. However, because this success should not be reduced to the low fees, we have only mentioned this advantage here at the end.