Since 2019, Credit Suisse Index Funds (CSIF) have been accumulating. This means that interest and dividends are generally retained in the fund and reinvested.

And yet there is a distribution, which we have credited to you as follows:

Details of dividend credits can be found in the Transaction Report or the Performance Report.

Details of dividend credits can be found in the Transaction Report or the Performance Report.

The fund pays the withholding tax to the Swiss Confederation

These dividend credits are the withholding tax that the fund must deliver to the Confederation. This means:

- 35% of the income earned by the fund from investments in shares or bonds must be delivered by the fund to the Confederation (withholding tax).

- 65% of the income is retained in the fund and invested in «new» shares or bonds.

We receive the withholding tax statements from Credit Suisse towards the end of May each year.

We use the Credit Suisse statements to reclaim the withholding tax from the federal government after the end of the tax year.

We prefinance the withholding tax refund for you

As soon as we receive the statements from Credit Suisse, we credit your portfolios with the withholding tax as a «dividend». In January of the following year, we then claim the withholding tax back from the federal government in bundled form.

- On the one hand, this «prefinance» has the advantage for you that the withholding tax can already be reinvested in the selected investment strategy on the next trading day.

- On the other hand, with this procedure you also benefit from the distribution if you leave us between the time of settlement by Credit Suisse and the refund by the Federal Tax Administration.

If we only credited the withholding tax once the refund had been made by the Federal Tax Administration, you would be left empty-handed if you left us in the meantime. This is despite the fact that you would be legally entitled to the dividend portion because you were in possession of the funds at the time Credit Suisse made the distribution to the Federal Tax Administration.

So as you can see, there are good reasons why we have decided to prefinance the withholding tax refund. Because it is in your interest.

FAQ

What influence does the distribution have on performance?

The distribution in and of itself has no influence on performance. The reason is as follows: on the day when the dividend is paid out, the price of the fund falls by the value of the distribution.

The following chart illustrates the above with a dividend of two francs:

This does not mean that dividends do not have a positive influence on performance. They very much do. However, this positive influence is distributed over the entire year because the dividends are increasingly priced into the market price of the shares and bonds and thus also into the value of the fund as the dividend date approaches.

The positive impact is therefore not linked to the distribution. Otherwise, you could buy funds shortly before the distribution and sell them again shortly afterwards and thus achieve a relatively risk-free return. But of course that is not possible.

How high is the dividend yield?

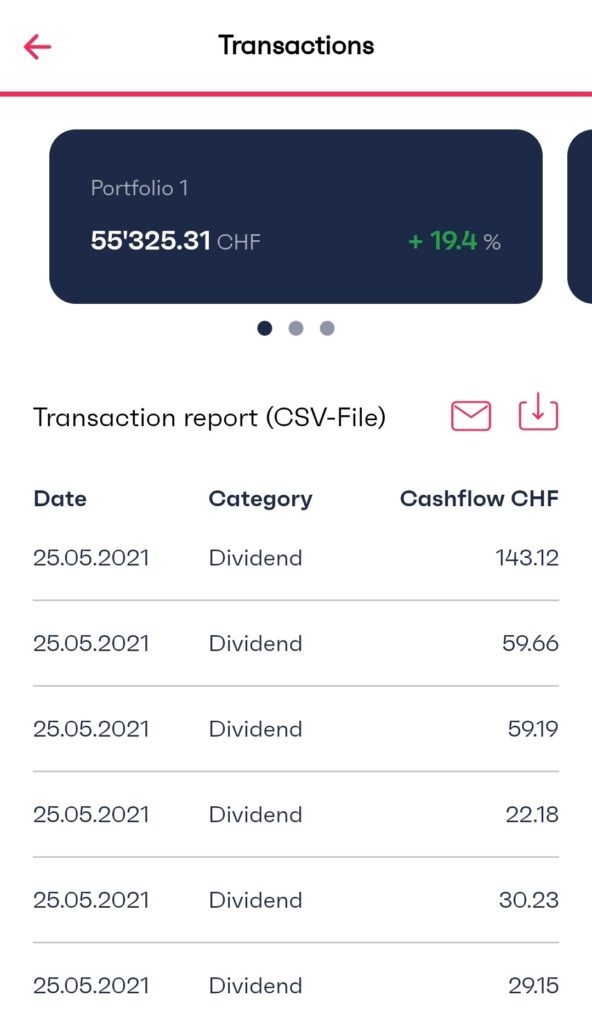

We will show you how to calculate the dividend yield. Again using the example of the print screen at the beginning of this article with the portfolio with the strategy finpension Global 100.

1. Add up the dividends paid out:

| Date | Category | Name | Dividend in CHF |

| 25.05.2021 | Dividend | CSIF (CH) Equity Switzerland Large Cap Blue ZB | 143.16 |

| 25.05.2021 | Dividend | CSIF (CH) III Equity World ex CH Blue – Pension Fund ZB | 59.66 |

| 25.05.2021 | Dividend | CSIF (CH) III Equity World ex CH Blue – Pension Fund ZBH | 59.19 |

| 25.05.2021 | Dividend | CSIF (CH) III Equity World ex CH Small Cap Blue – Pension Fund DB | 22.18 |

| 25.05.2021 | Dividend | CSIF (CH) Equity Switzerland Small & Mid Cap ZB | 30.23 |

| 25.05.2021 | Dividend | CSIF (CH) Equity Emerging Markets Blue DB | 29.15 |

| Total Dividends | 343.57 |

2. Extrapolate the withholding tax advance to 100%:

343.57 * 100 / 35 = 981.63

3. Put it in relation to the invested capital:

981.63 * 100 / 55’325.31 = 1.77 %