Why we say that ETFs are not a good choice in pillar 3a may come as a surprise. Mainly because we also believe in the added value of a passive investment strategy, and prefer it to active management.

1. reason why ETFs are not recommended in pillar 3a

There is a good reason why, unlike our competitors, we do not recommend ETFs as investment components for the 3a custody account. But in order to understand this, we first need to backtrack a bit.

ETF is the abbreviation for Exchange Traded Fund. So these funds are traded on the stock exchange and can be bought by everyone. And this is exactly the problem with ETFs.

This is because pension assets would actually receive privileged treatment when it comes to withholding taxes. However, this is only the case if the pension assets are not mixed with other assets.

If a fund does not restrict the circle of investors to pension assets and also allows investments with money from free assets, it is tainted and cannot benefit from the privilege in the double taxation agreements.

3rd pillar funds are privileged

Let’s take the USA as an example. The US stock market is very important. In the MSCI World Index, which tracks the stock markets of the Western world (including Japan), US companies currently account for 68 percent.

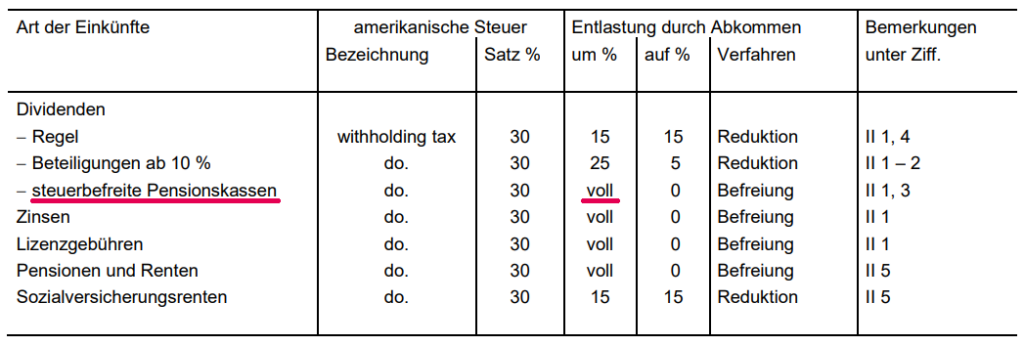

Switzerland has a double taxation agreement with the U.S. in which pension funds are fully exempt from withholding tax on dividends:

Since the approval of the amendment protocol as of January 1, 2020, 3a funds are now also privileged and benefit from the exemption from withholding tax in the USA.

What is a withholding tax?

In Switzerland, we know the withholding tax under the term “Verrechnungssteuer“.

Let’s take the example of a company that pays a dividend to its shareholders. This company must pay 35% of the dividend to the federal government and may only pay 65% to the shareholders. The 35% withholding tax serves as a pledge to the federal government, so that the recipients of the dividend declare it correctly in their tax returns. Only then will they get the withholding tax back.

This is how it works abroad, or in a similar way. The only difference is that internationally we do not speak of “Verechnungssteuer”, but of withholding taxes, which are deducted from income such as dividends or interest.

What are the benefits of a withholding tax exemption in pillar 3a?

If the fund is pure, i.e. it only manages pension assets of the 2nd or 3rd pillar, then it will be exempt from withholding tax upon application. The difference in performance between a fund exempt from withholding tax and a fund not exempt from withholding tax is considerable, as you can see from this comparison of the performance of two funds (factsheets from the end of April 2021):

| Titel | Category | 1 y. | 3 y. | 5 y. |

| CSIF (CH) I Equity World ex CH Blue ZB | not exempt from withholding tax | 38.32% | 37.20% | 84.78% |

| CSIF (CH) III Equity World ex CH Blue – Pension Fund ZB | exempt from withholding tax | 38.70% | 38.68% | 88.12% |

| Outperformance | thanks to withholding tax exemption | 0.38% | 1.48% | 3.34% |

Those who forgo this performance advantage must take it into account as an indirect cost when comparing ETF solutions with other withholding tax-optimized pension solutions.

It is very likely that by then the ETF offering will already not look so good.

What’s better than an ETF in pillar 3a?

Better than ETF are funds that meet the following conditions:

- They are not traded on the stock exchange.

- Only pension funds and their clients can subscribe to these funds.

finpension uses such funds in pillar 3a. These are the institutional index funds of Credit Suisse and Swisscanto.

Index funds pursue the same objective as ETFs. However, since they are not traded on the stock exchange, they can control the investor base and thus benefit from the advantage in double taxation treaties.

Conclusion

Privately, you make sure that the withholding tax is reclaimed. No one wants to forgo this money.

Some thing counts in the area of pension provision. Therefore, a provider who addresses this issue is to be preferred.

You, as a private investor, can see if this is the case. And this with one single question:

What instruments does the provider use?

- Funds with a restricted group of investors = tax-optimized

- Funds like ETF without investor group control = not tax optimized

2. capital gains are not the primary objective in pension plans

This statement may also come as a surprise. After all, capital gains are interesting in principle, with a medium-sized “but”.

With the variety of ETFs available on the market, it is possible to focus very specifically on a growth strategy. In such a strategy, dividends play a subordinate role. More important are promising sectors that still have their heyday ahead of them.

The disadvantage of such a strategy, which aims at capital gains, is the capital withdrawal tax. This is because you pay a tax when you withdraw pension assets such as the 3rd pillar. This means that you also pay capital gains tax on the part of your pension assets that was generated by capital gains.

This is in complete contrast to free assets. In free assets, capital gains are tax-free. Therefore, one should focus on income and not on capital gains in pension provision. And if one focuses on income, exemption from withholding tax is a “must”. ETFs are therefore also excluded from this point of view.

3. investing in sustainability does not have to be more expensive

Even when it comes to sustainable investment of the 3rd pillar, you don’t necessarily have to settle for second-rate ETFs.

This is because the major index fund providers such as Credit Suisse have also recognized the need for sustainable investments and offer a line of funds that meet sustainability criteria (ESG criteria).

These are also optimized for withholding tax and are comparable in cost to conventional funds. Here is an example using a Credit Suisse index fund that covers the MSCI World:

| Funds | ISIN | TER | ||

| conventional | CSIF (CH) III Equity World ex CH Blue – Pension Fund Plus ZB | CH0429081620 | 0.00 % | Factsheet |

| conventional | CSIF (CH) III Equity World ex CH Blue – Pension Fund Plus ZBH | CH0429081638 | 0.00 % | Factsheet |

| sustainable | CSIF (CH) III Equity World ex CH ESG Blue – Pension Fund Plus ZB | CH0337393745 | 0.02 % | Factsheet |

| sustainable | CSIF (CH) III Equity World ex CH ESG Blue – Pension Fund Plus ZBH | CH0337393851 | 0.02 % | Factsheet |

In principle, EFTs are a good thing, but not in a pillar 3a

So in principle, ETFs are a good thing. Many have realized that active fund management is useless in the long run. They therefore invest in ETFs that follow the market, but do not try to beat it. Significantly lower costs are a certainty for these investors, as is average market performance.

However, for the reasons mentioned in this article, ETFs are not suitable for retirement planning and pillar 3a.