Advantages of the 3a securities app from finpension

1. Lower fees without foreign currency exchange fees

Our 3a securities app is very affordable. The costs range from 0.39 to 0.42 %* per year. That’s up to 75% less than traditional retirement funds.

* 0.39 % management fee and 0.00 to 0.03 % fund costs (TER).

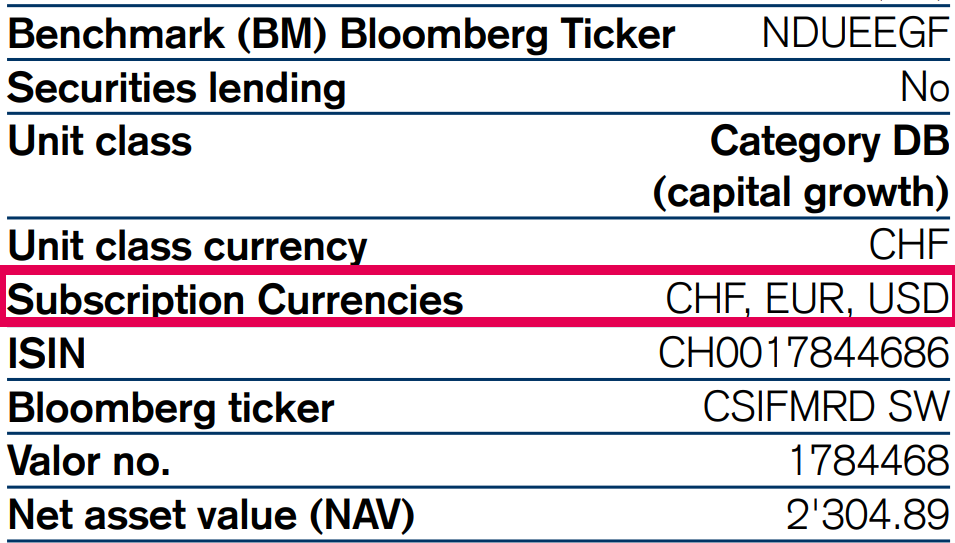

We also waive the fees on foreign currency exchanges. Here an explanation: The funds we use can be subscribed in different currencies:

Unlike our competitors, we invest in the CHF-tranches. If necessary, the exchange into the other currency, for example into the USD, takes place within the fund at the average exchange rate and without a premium.

This is relevant because competitors sometimes invest in the foreign currency tranches on purpose to earn some money on a little-noticed sideline (foreign currency exchange).

2. Better performance thanks to exemption from foreign taxes on dividends and interests

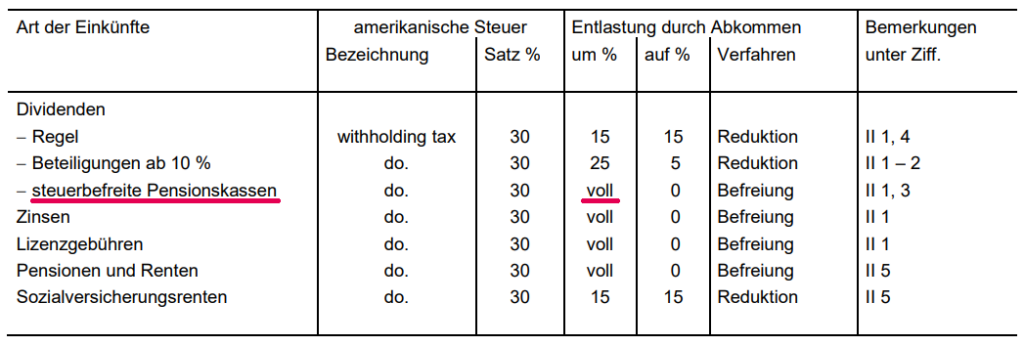

We use funds that are only accessible to pension funds. Because the circle of investors is very restricted, the funds can be exempted from tax on foreign income.

This is because of the preferential treatment in the international double taxation agreements, as illustrated here with the example of the USA:

The exemption from withholding taxes on foreign dividends and interests leads to an additional return of up to 0.4% per year compared to the funds that are not exempt from withholding taxes.

Since June 2021, we have also been the first 3a pension foundation to invest in the Pension Fund class for Japan. This has resulted in a further performance advantage.

It is not a matter of course that pension funds are optimised regarding the withholding tax. We made a quality check of several pension funds and found that many providers do not make this effort.

3. Higher interest rates on bond and money market funds than on a 3a account

Another reason to go with the 3a securities app from finpension is the yield to maturity on bond investments. They are now significantly higher than the interest rate you get on a cash 3a account. Please note, however, that currency losses are to be expected due to higher inflation in other countries.

| Fund name | ISIN | Share in % | Yield to maturity* p.a. |

| Swisscanto (CH) Index Bond Fund Corp. World hedged CHF NTH1 CHF | CH0117052511 | 40 | 4.71% |

| Swisscanto (CH) Index Bond Fund Total Market AAA-BBB CHF (I) NT CHF | CH0117045036 | 30 | 0.90% |

| Swisscanto (CH) Index Bond Fund World (ex CHF) Govt. hedged CHF NTH CHF | CH0117045317 | 20 | 3.17% |

| Swisscanto (CH) Index Bond Fund Emerging Markets Hard Currency NTH CHF | CH0398970274 | 10 | 6.35% |

| Total weighted yield to maturity | 3.42% |

4. More effective thanks to advance payments of the VST reclaim from the federal government

Finally, our 3a securities app is more effective because we advance you the withholding tax. This means that the withholding tax can be reinvested more quickly, resulting in a higher interest rate.

Here a brief explanation: A portion of the funds used must pay withholding tax to the federal government each year. We can only reclaim this withholding tax from the federal government in spring. But we do not wait for that. We credit the withholding tax to you immediately after we receive the statement from the custodian bank.

Example of the procedure:

- May 2023: Delivery of withholding tax to the government (by custodian bank).

- May 2023: Crediting of the withholding tax to the client portfolios (by the foundation)

- January 2024: Reclaim of withholding tax from the government (by foundation)

- March 2024: Payment of the withholding tax to the Foundation (by the government)

The «advance payment» of this VST reclaim has two advantages for our clients:

- The withholding tax is already reinvested on the next trading day.

- Our clients do not miss out on the withholding tax, even if they leave us between the settlement by the custodian bank and the repayment by the Federal Tax Administration.