FAQ

Anyone who has earned income that is subject to AHV contributions can pay into the tied pension plan (pillar 3a) and deduct the payments from their taxable income. Payments can be made from the year you turn 18 until you reach the regular AHV retirement age.

Anyone who can prove that he or she is in gainful employment beyond the normal retirement age can continue to pay in pillar 3a for a maximum of five years beyond the normal retirement age and continue to pay in during this period.

Information on special cases (unemployment, cross-border commuters, early retirement) can be found in the following article: Who is entitled to pay into the 3rd pillar?

Copy linkFrom the year you turn 18, you can pay into the pillar 3a. However, this is subject to the condition that you have an earned income subject to AHV contributions.

Copy linkYou can pay into the pillar 3a until you reach the regular AHV retirement age. Beyond that, payments can only be made if you can prove that you are still employed. At the latest, however, at the age of 69 or 70 (women/men), the pillar 3a must be dissolved and the credit balance withdrawn.

Copy linkYes, provided both partners have an income from employment subject to AHV contributions, both can pay into pillar 3a and thus build up a private pension plan. However, if one partner’s income is settled in the simplified settlement procedure, he or she cannot make a payment.

Copy linkThe law does not limit the number of 3a accounts. finpension’s 3a retirement savings foundation allows up to five portfolios per person.

Copy linkNo, the law does not permit the splitting of credit balances on a 3a account among several 3a accounts. Partial withdrawals are only possible for residential property. In all other cases, only the entire balance can be withdrawn at once. If you would like to be able to withdraw retirement assets in stages at a later date, you must therefore open several 3a accounts.

Copy linkYes, as with 3a accounts, the portfolios can also be purchased separately from the finpension 3a pension foundation.

We have chosen the term ‘portfolio’ because the finpension 3a Retirement Savings Foundation offers both a 3a account and pension funds.

Copy linkThe identity of the insured person is recorded via his or her name, date of birth and telephone number, which is verified with an SMS code. The client cannot change this information independently in the app.

Pension funds for the second and third pillar aren’t subject to the Swiss anti-money laundering act. Therefore, finpension 3a retirement savings foundation isn’t required to formally identify the insuree.

New: Digital ID check (optional)

Would you still like us to check your personal details on the basis of an identity document? Then a digital ID card check is now available to you. To do this, open the profile in the top right-hand corner after registering. There you will find the menu item «ID check (optional)».

Copy linkYes, that’s possible. You can have 3a accounts or custody accounts cancelled and transferred to another provider. Transferring 3a funds to finpension is quite simple.

Copy linkTo transfer money to the finpension 3a Retirement Savings Foundation, follow the deposit button in the app. You will receive a form that you can submit to your previous provider.

Copy linkIf you already have a 3a account, you can only transfer «en bloc». This means that you cannot transfer just any amount, but must always transfer the entire balance of a 3a account.

If you have more than one 3a account, you can move each balance around and transfer it from one provider to another.

Copy linkYes, the 3a credit balances with finpension 3a Retirement Savings Foundation can be withdrawn at any time.

Copy linkWe neither prescribe that you have to deposit nor how much. You can always determine both the amount and the timing of deposits yourself. There is therefore no minimum amount for pillar 3a with finpension.

Copy linkIn legal terms, pillar 3a is an extension of occupational pension provision (second pillar). In occupational pension provision, pension assets are held in pension funds*, which also have the legal form of a foundation. For this reason, when Pillar 3a was introduced in 1985, the Federal Council decided that payments into Pillar 3a must also be made into foundations. Specifically, these are pension foundations whose sole purpose is tax-privileged tied pension provision within the meaning of Article 82 of the Occupational Pensions Act (BVG).

* or insurance (but not relevant for this declaration)

Further information on the topics covered in the video can be found in our articles:

Copy linkA distinction is made between persons who are affiliated to a pension fund (2nd pillar) and those who are not affiliated to a pension fund. For people with a pension fund, the maximum payment for one year is limited to 7,056 francs. Without a pension fund, you may pay up to 35,280 francs into a pillar 3a, but no more than 20% of net earned income (gross income less AHV, IV, EO and ALV contributions).

Missed payments cannot be made up in later years.

Copy linkA major advantage of pillar 3a is the tax savings. Payments can be listed in the tax return under «deductions», which leads to a reduction in taxable income. If you have little income and therefore pay relatively little tax, it is not so interesting to pay into pillar 3a. It is more interesting to make a deposit in the years when you earn full. In this case, the tax deduction is more effective and you save the most tax.

Copy linkYes, you can also enter a standing order and thus make regular deposits. We do not charge any fees for deposits. We credit the deposits to the respective portfolio free of charge and invest the amount weekly in the chosen strategy.

Copy linkThe free funds on a 3a portfolio are invested in the chosen strategy on the second banking day of each week.

Copy linkRegardless of the amount of the deposit, we do not charge any fees for deposits or for transfers from existing 3a credit balances.

Copy linkYes, that is possible.

Copy linkThe payment must be made in good time before the end of the year (at the latest with value date last bank working day of the year).

Copy linkYou can already choose a strategy when you register. You can then change the strategy at any time free of charge by choosing another strategy or by customizing the strategy.

Copy linkDeposits and transfers are invested on the second bank working day of the week (trading day). In order to still be taken into account on the trading day, the deposits and transfers must be received in the account of finpension 3a Retirement Savings Foundation on the previous day.

Procedure in detail: The bank of the finpension 3a Retirement Savings Foundation collects the incoming payments and makes a file available at the end of the day. This file is read in by us on the following day, whereby the deposits and transfers are credited to the portfolios. Afterwards, the buy and sell orders of the funds are generated (the latter assuming that it is the second banking day of the week).

Copy linkIf you want to be sure that the strategy change will be implemented, you must make the change by the end of the day before the trading day. For changes on the trading day, we cannot say whether they will still be taken into account or not. The cut-off time may vary.

Copy linkDue to price fluctuations or changes in strategy, the effective weightings of the fund units may deviate from the specified target weightings of the investment strategy.

If the weighting of a fund deviates from the target weighting by more than one percentage point, your entire portfolio will be realigned. Fund units are sold and purchased to restore the target weightings of the individual index funds. This process is called rebalancing.

It is performed weekly on the second banking day of the week. There are no transaction costs involved.

Copy linkIn the application you can create a request that you want to withdraw the portfolio. You will then receive an e-mail with the form which you must fill in and return signed for the purchase. As soon as the form has been completely filled in and signed, we will set your investment strategy to “in liquidation”. On the second bank working day of the next week the fund units will then be sold and the proceeds will be credited to your account. Afterwards the payment will be made.

If you would like to reduce the investment risk immediately, you can of course do this free of charge. We recommend that you choose a strategy with a low equity component. The change of strategy will be implemented on the second bank working day of the following week.

Copy linkThe payment must be recorded in the tax return under “deductions”. In addition, the payment certificate from the pension foundation must be enclosed with the tax return. The payment certificate can be downloaded from the app under Documents.

Copy linkThe law distinguishes between “residents” and “non-residents” in Switzerland.

“Residents” (e.g. residence permit B)

Art. 9 Withholding Tax Ordinance (only in German, French oder Italian)

If you earned a gross amount of CHF 120,000 or more in one year, you will be assessed retrospectively. This means that you first pay the tax at source, but this is subsequently revised through an ordinary tax procedure (with the submission of a tax return). Within the framework of this subsequent ordinary assessment, you can deduct your payment into pillar 3a.

If you earn less than CHF 120,000 gross, you will not automatically be assessed retrospectively. Until now, you could apply for a retrospective rate correction of the withholding tax for the 3a deduction. This retrospective rate correction is no longer possible from the 2021 tax year. However, you can now voluntarily apply for a retrospective ordinary assessment. You must observe the following points:

- The application for a retrospective ordinary assessment must be submitted by 31 March of the year following the tax year.

- If you are subject to a subsequent ordinary assessment, this system also applies to the following years (until the end of the withholding tax liability in Switzerland).

A retrospective ordinary assessment can lead to both a higher and a lower tax burden. You should therefore clarify in advance whether it is worthwhile for you to switch to the retrospective ordinary assessment because you can deduct the payment into pillar 3a or voluntary purchases into the pension fund.

“Non-residents” (e.g. weekly residents)

Art. 14 Withholding Tax Ordinance (only in German, French oder Italian)

Also for persons without tax residence in Switzerland (e.g. cross-border commuters to Germany with a weekly stay in Switzerland), a subsequent tarrif correction of the withholding tax is no longer possible from the tax year 2021.

Weekly residents can now also be subject to retrospective ordinary assessment. However, this is only the case if they generally earn and pay tax on at least 90 per cent of their worldwide income in Switzerland. Then they are considered “quasi-residents” by law.

As with residents, the question arises as to whether a subsequent ordinary assessment is worthwhile. Unlike residents, however, quasi-residents have the option of deciding each year new whether they want a subsequent ordinary assessment or not (cf. page 669 of the dispatch). This does not automatically apply to subsequent years as well.

Copy link3a assets do not have to be declared in the tax declaration. The assets are tax-free. Income from the retirement assets (dividends and interest) does not have to be declared either. They are also tax-free.

Copy linkNo, dividends and interest earned on pension assets are not taxable as income. The assets do not have to be listed in your tax declaration either. Pension assets are tax-exempt until they are withdrawn.

Copy linkYes, rebalancing can be deactivated. If you click on the three dots on the portfolio, a context menu will open where you will see the «Rebalancing» item. You can use this to deactivate rebalancing and reactivate it if you wish.

Copy linkYes, withholding tax is generally deducted on foreign dividend and interest income. However, as the index funds used can only be subscribed by pension funds, the funds can reclaim a large part of the withholding taxes.

Copy linkYes, there is a tax on the withdrawal of pension benefits. However, it is a reduced tax. This means that the tax rate is lower than income tax. With a staggered withdrawal, the tax can be further reduced on withdrawal.

Copy linkIn principle, pillar 3a credit balances can be withdrawn at the earliest five years before the normal AHV retirement age.

Copy linkAn early payout of 3a credit balances is possible in the following cases:

- To finance home ownership (home-ownership promotion).

- For taking up self-employment.

- If you emigrate and leave Switzerland permanently.

- When receiving a full disability pension and the risk of disability is not insured.

3a credit balances must be withdrawn at the latest when you reach your normal AHV retirement age. However, if you can prove that you are still in gainful employment, you can continue your pillar 3a credit balance for up to five years beyond that date. During this period you can continue to pay in your contributions. Once you reach the regular AHV retirement age, you can close 3a accounts at any time and withdraw the credit balance.

Copy linkThe finpension 3a Retirement Savings Foundation does not engage in proprietary trading. Purchases and sales of securities are made exclusively on behalf and for the account of the account holder.

The business risk lies with finpension AG. Example employees: they are not employed by the Retirement Savings Foundation, but by finpension AG. If finpension AG were to go bankrupt, this would not affect the retirement savings held by finpension 3a Retirement Savings Foundation. The board of finpension 3a Retirement Savings Foundation would then have the task of transferring the management to another company.

Copy linkAccount balances are privileged up to CHF 100’000 per account holder. In a bank bankruptcy they fall into the second category not the third. And securities balances are even better off than account balances. Securities are not shown on the bank balance sheet. They are regarded as special assets and, unlike account balances, do not fall into the bankruptcy assets of the bank. So with finpension 3a Retirement Savings Foundation, your pension provision is as secure as possible.

Copy linkIn contrast to e-banking, bank transfers cannot be instructed via the finpension app. For withdrawals and transfers, the corresponding forms must be signed and submitted in the original.

Copy linkSince 2019, Credit Suisse Index Funds (CSIF) have been accumulating. This means that interest and dividends are generally retained in the fund and reinvested.

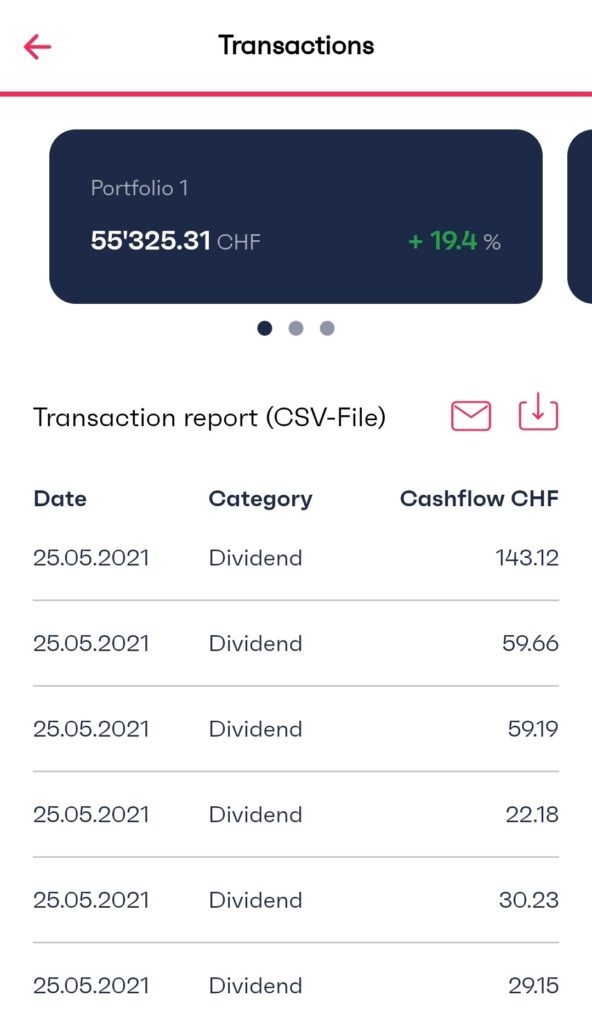

And yet there is a distribution, which we have credited to you as follows:

Details of dividend credits can be found in the Transaction Report or the Performance Report.

Details of dividend credits can be found in the Transaction Report or the Performance Report.

The fund pays the withholding tax to the Swiss Confederation

These dividend credits are the withholding tax that the fund must deliver to the Confederation. This means:

- 35% of the income earned by the fund from investments in shares or bonds must be delivered by the fund to the Confederation (withholding tax).

- 65% of the income is retained in the fund and invested in «new» shares or bonds.

We receive the withholding tax statements from Credit Suisse towards the end of May each year.

We use the Credit Suisse statements to reclaim the withholding tax from the federal government after the end of the tax year.

We prefinance the withholding tax refund for you

As soon as we receive the statements from Credit Suisse, we credit your portfolios with the withholding tax as a «dividend». In January of the following year, we then claim the withholding tax back from the federal government in bundled form.

- On the one hand, this «prefinance» has the advantage for you that the withholding tax can already be reinvested in the selected investment strategy on the next trading day.

- On the other hand, with this procedure you also benefit from the distribution if you leave us between the time of settlement by Credit Suisse and the refund by the Federal Tax Administration.

If we only credited the withholding tax once the refund had been made by the Federal Tax Administration, you would be left empty-handed if you left us in the meantime. This is despite the fact that you would be legally entitled to the dividend portion because you were in possession of the funds at the time Credit Suisse made the distribution to the Federal Tax Administration.

So as you can see, there are good reasons why we have decided to prefinance the withholding tax refund. Because it is in your interest.

FAQ

What influence does the distribution have on performance?

The distribution in and of itself has no influence on performance. The reason is as follows: on the day when the dividend is paid out, the price of the fund falls by the value of the distribution.

The following chart illustrates the above with a dividend of two francs:

This does not mean that dividends do not have a positive influence on performance. They very much do. However, this positive influence is distributed over the entire year because the dividends are increasingly priced into the market price of the shares and bonds and thus also into the value of the fund as the dividend date approaches.

The positive impact is therefore not linked to the distribution. Otherwise, you could buy funds shortly before the distribution and sell them again shortly afterwards and thus achieve a relatively risk-free return. But of course that is not possible.

How high is the dividend yield?

We will show you how to calculate the dividend yield. Again using the example of the print screen at the beginning of this article with the portfolio with the strategy finpension Global 100.

1. Add up the dividends paid out:

| Date | Category | Name | Dividend in CHF |

| 25.05.2021 | Dividend | CSIF (CH) Equity Switzerland Large Cap Blue ZB | 143.16 |

| 25.05.2021 | Dividend | CSIF (CH) III Equity World ex CH Blue – Pension Fund ZB | 59.66 |

| 25.05.2021 | Dividend | CSIF (CH) III Equity World ex CH Blue – Pension Fund ZBH | 59.19 |

| 25.05.2021 | Dividend | CSIF (CH) III Equity World ex CH Small Cap Blue – Pension Fund DB | 22.18 |

| 25.05.2021 | Dividend | CSIF (CH) Equity Switzerland Small & Mid Cap ZB | 30.23 |

| 25.05.2021 | Dividend | CSIF (CH) Equity Emerging Markets Blue DB | 29.15 |

| Total Dividends | 343.57 |

2. Extrapolate the withholding tax advance to 100%:

343.57 * 100 / 35 = 981.63

3. Put it in relation to the invested capital:

981.63 * 100 / 55’325.31 = 1.77 %

Copy linkA fund can consist of different classes. Each class is reserved for a different group of investors. For example, there are funds that have different classes for retail investors and institutional investors.

We have successfully campaigned for you

Thanks to our initiative, from 1 June 2021 we will now be the first 3a pension foundation to be able to invest in the Credit Suisse Index Fund classes, which also reclaim withholding taxes on securities in Japan. Previously, these fund classes were reserved for second pillar pension funds.

However, the descriptions of the previous and the new fund classes are not entirely logical in this respect. But see for yourself:

| Fonds | Previously Fund class (not exempt from withholding tax) | New as of June 1, 2021 Fund class (withholding tax free) |

| CSIF (CH) I Equity Japan Blue | Plus ZB | Pension Fund ZB |

| CSIF (CH) I Equity Japan Blue | Plus ZBH | Pension Fund ZBH |

| CSIF (CH) III Equity World ex CH Blue | Pension Fund ZB | Pension Fund Plus ZB |

| CSIF (CH) III Equity World ex CH Blue | Pension Fund ZBH | Pension Fund Plus ZBH |

| CSIF (CH) Equity World ex CH ESG Blue | ZB | Pension Fund Plus ZB |

| CSIF (CH) Equity World ex CH ESG Blue | ZBH | Pension Fund Plus ZBH |

Change to Japan withholding tax exempt classes as of 1 June 2021

Read on to find out how avoiding withholding tax pays off.

What the other descriptions mean

While we’re at it, let us show you what other relevant descriptions used by CS in the fund name mean:

– CSIF: Credit Suisse Index Fund

– (CH): Fund domicile Switzerland

– Blue: The designation “Blue” means that the fund does not lend the securities held (no securities lending)

– Z: Zero fee class (TER is generally 0.00 %)

– H: Currency risks are hedged against Swiss francs

Copy linkThree assets replaced in the strategies with investment focus sustainable

New sustainable funds are available. We are using these new funds in the standard strategies with a «sustainable» investment focus from 31 August 2021. This will make our sustainable strategies even more sustainable.

| Funds used so far | Newly deployed funds |

|---|---|

| CSIF (CH) Bond Switzerland AAA-BBB Blue ZB | CSIF (CH) Bond Switzerland AAA-BBB ESG Blue ZB |

| CSIF (CH) Equity Switzerland Large Cap Blue ZB | CSIF (CH) Equity Switzerland Total Market ESG Blue ZB |

| CSIF (CH) Equity Switzerland Small & Mid Cap ZB |

Further investment instruments with ESG focus available

In addition, we have made further ESG funds available for all those who would like to adapt their strategy themselves. The standard strategy can be adapted at any time free of charge by changing the strategy and selecting the investment focus «customized».

| Asset name | ISIN | TER |

|---|---|---|

| CSIF (CH) I Equity Europe ex CH ESG Blue ZB | CH0507420005 | 0.06 % |

| CSIF (CH) I Equity Europe ex CH ESG Blue ZBH | CH0526615825 | 0.06 % |

| CSIF (CH) III Equity US ESG Blue – Pension Fund ZB | CH0397628709 | 0.03 % |

| CSIF (CH) III Equity US ESG Blue – Pension Fund ZBH | CH0397628717 | 0.02 % |

| CSIF (CH) I Equity Canada ESG Blue – Pension Fund ZB | CH0504896439 | 0.06 % |

| CSIF (CH) I Equity Japan ESG Blue – Pension Fund ZB | CH1102994071 | 0.03 % |

What does ESG mean?

Credit Suisse uses the term ESG for those funds that meet sustainability criteria. ESG stands for:

- Environmental

- Social

- Governance

- All

- Opening a portfolio

- Transferring money

- Depositing money

- Purchase and sale of fund units

- Saving taxes

- Withdraw portfolio

- Security

- Various