With this article, I would like to show where the leverage effect of the 2nd pillar is and how, with small changes to the legal framework, a future-oriented reform with a significantly higher benefit level could be implemented in the interest of all insured persons. Ideas to stimulate thought.

Where are there leverage effects in pension provision?

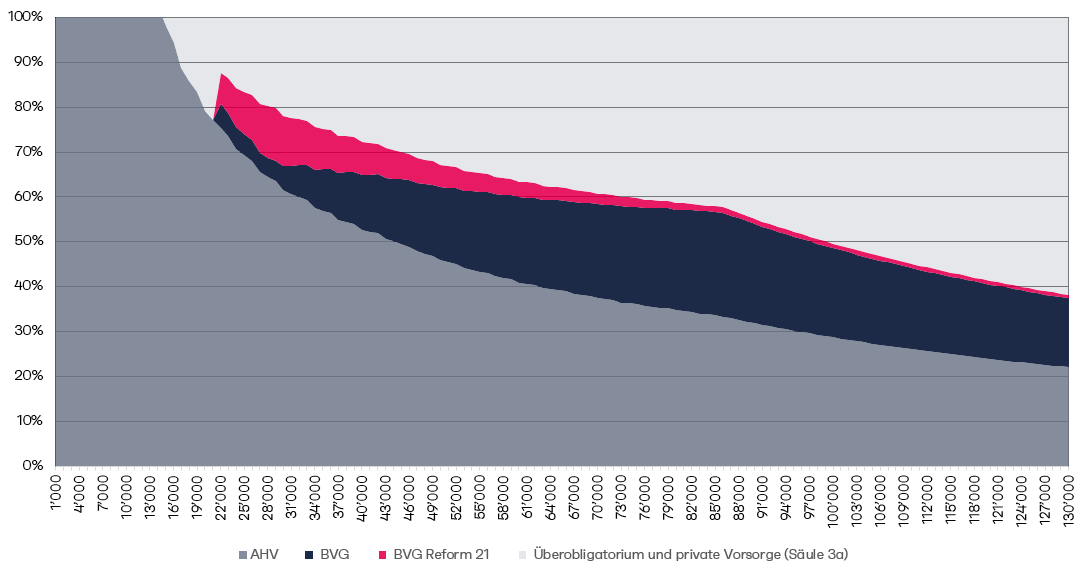

The following chart shows the amount of retirement benefits as a percentage of income. In the case of a low income, the AHV retirement pension represents a high proportion of retirement benefits. The occupational pension plan only takes effect from an income of CHF 21’510.

The Federal Constitution states the following principle in Art. 113 para. 2 let. a: The occupational benefit plan, together with the old-age, survivors’ insurance (AHV), enables the continuation of the accustomed standard of living in an appropriate manner. The two terms “accustomed lifestyle” and “appropriate manner” are undefined legal terms, behind which, however, according to the Federal Social Insurance Office, there are concrete ideas. The benefit target is that the combined AHV and pension fund pensions reach around 60 % of the previous salary.

The chart shows the impact of the BVG reform in red. The reduction of the coordination deduction by half leads to a significant improvement in benefits for lower incomes, despite the reduction in the conversion rate. The calculation is based on the assumption that all retirement credits were made on the same salary and that no return was achieved on the investment capital. Up to an income of just under CHF 75’000, the benefit target of 60 % of the previous salary can be achieved.

The calculation depends on many factors. All contributions are based on an average salary. A steady salary increase over the entire employment phase will probably no longer be the rule in the future. A reduction in the workload after a certain age, rainbow careers, performance-based pay and freelancer models are likely to become more widespread. The calculation based on an average wage therefore appears suitable for comparison.

In the 2nd pillar, the amount of retirement capital at the time of retirement is crucial for determining the retirement benefit. When a pension is drawn, the existing retirement capital is multiplied by the applicable conversion rate to fix the annual retirement pension.

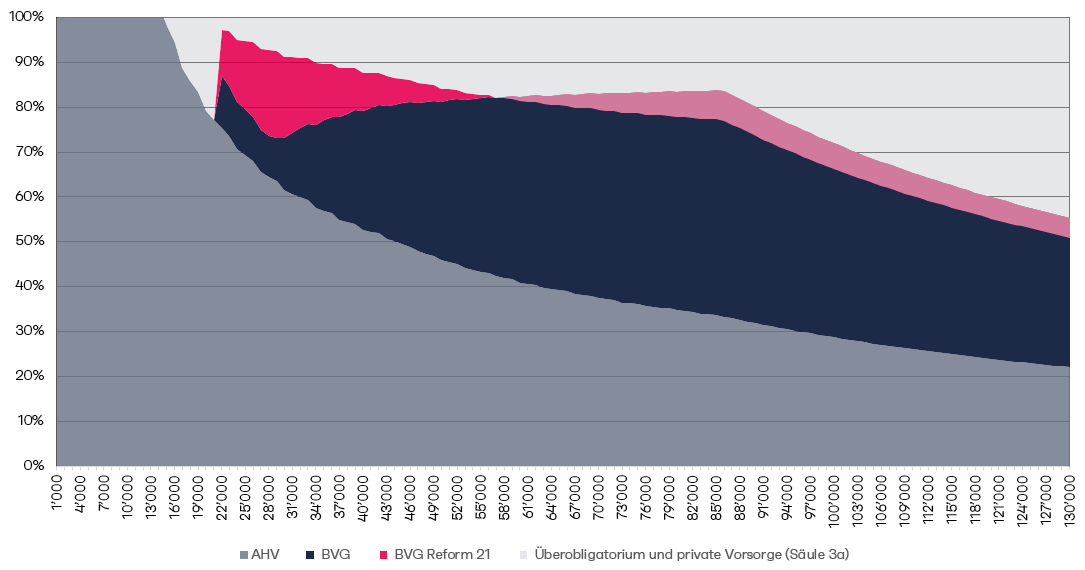

In order to increase the benefit level, various approaches are possible, such as increasing the retirement age, starting the savings process earlier or even increasing contributions. In the chart, the blue and red areas would have to be extended toward the top. Although the mentioned approaches have a certain effect, they are always associated with a cost consequence for employers and are correspondingly difficult to implement. The investment return has a completely different effect.

In the example below, an annual investment return of 3 % is assumed. The projected retirement capital increases massively as a result. Up to a salary of CHF 110’000, even the benefit target of 60 % of the previous salary can now be achieved. However, the reduced conversion rate of the planned reform proposal means that, under this assumption, retirement benefits from a salary of CHF 58’000 are lower with BVG-reform 21 than before the reform (light red area).

With a return assumption of 5 %, the interest-rate effect becomes impressive. The performance target is significantly exceeded with over 100 % of the salary in a broad salary range (the blue and red areas overlap the graph).

Is an investment return of 5 % not realistic? On average, a pension fund invests about 30 % of its pension capital in equities and about 20 % in real estate. With 50 % nominal value investments in a negative interest rate environment, an investment return of 5 % is not realistic. A pure equity strategy should achieve this return. To avoid strong fluctuations against the reference date, the risk could be reduced in the last 5-10 years.

Why is there no such pension fund model? The added value for the insured persons would be immense, the opportunity costs of the current system are high. According to Credit Suisse Research Institute[1], the annual nominal return for the U.S. stock market from 1900 to 2019 was 9.6 % per year, while the real return was 6.5 %. The real return of the Swiss stock market was just under 5 % in the same period.

With a pure equity strategy, it should be possible to deal with strong fluctuations in value. In the period from 1900 to 2019, many stock market crises had to be endured (e.g. World War 1, Wall Street crash and the Great Depression, OPEC oil price shock, dotcom bubble, major financial crisis). In some cases, temporary price losses of up to 80 % were the result. In the long-term view, however, these downturns can hardly be seen on a line chart showing the performance. In addition, it should be noted that the annual contribution payments lead to a strong smoothing of the cost prices.

The investment return is the leverage effect. There are few arguments against stocks for a long-term investment horizon. The AHV pension assets would be predetermined for a pure equity investment. In occupational pension plans, a comparable model would be feasible for the savings phase:

- The annual contributions are invested in a GDP-weighted world stock index.

- From age 55, the equity risk is reduced by 10 % annually

- The return is credited to the personal account (no redistribution)

- For contributions above the BVG mandatory level, the insured person can choose his own investment strategy (1e model)

Conclusion

In order to move forward, we have to be willing to cut off old habits, otherwise we will never find our way out of the impasse. For the younger generations, it is to be hoped that a pension-Greta can soon be found that also brings sustainability to pension provision in a figurative sense.

To the lead article: BVG Reform 21 in a dead end: What are the ways out?

Beat Bühlmann, Managing Director finpension AG

[1] Credit Suisse, Research Institute, Summary Edition Credit Suisse Global Investment Returns Yearbook 2020