With this comparison, we want to help you find the best vested benefits account in Switzerland for you. In addition to comparing the interest rates and fees of almost 80 banks, you will also find out the average interest rate on a vested benefits account.

Table of contents

How do I find the best vested benefits account in Switzerland?

To find the best vested benefits account for you, you can use the following criteria as a guide:

- Interest rate: This is probably one of the most important factors when choosing a vested benefits account. If the interest rate on the vested benefits account is higher, your pension assets will grow faster. It is worth comparing vested benefits accounts on a regular basis, as interest rates often change.

- Fees: In addition to the interest rates, you should also pay attention to the fees. Some providers charge fees for account management or WEF withdrawals. Such fees reduce the growth of your pension assets and can even lead to a loss.

- Flexibility and ease of opening: Another important point is how easily you can open and close the account. As vested benefits accounts are often only held for a short period of time, providers with streamlined processes are a good choice. The processes of digital providers are often the simplest.

The best vested benefits account in terms of interest rate

The Hypo Vorarlberg and the Caisse d’Epargne d’Aubonne currently offer the highest interest rate at 0.5%. In second place is the Caisse d’Epargne de Cossonay with 0.4%. All other providers offer interest rates of 0.375% or lower.

In our comparison of vested benefits accounts, you can compare not only the interest rates, but also the fees for account management, balancing and WEF withdrawals. The fees are only indicative and may vary depending on the conditions. For example, many banks have a rule that the WEF fee is lower if the mortgage is taken out with them. The table can be sorted in any order.

Comparison of interest and fees on vested benefits accounts

| January 2026 | Ø last 5 years | Account Management p.a. | WEF Advance Withdrawal | Cash Out | |

|---|---|---|---|---|---|

| Caisse d'Epargne d'Aubonne | 0.500% | 0.460% | 36.00 | n.a. | n.a. |

| Hypo Vorarlberg (Schweiz) | 0.500% | - | - | 400.00 | 25.00 |

| Caisse d'Epargne de Cossonay | 0.400% | 0.297% | - | 400.00 | 25.00 |

| Clientis Bank Thur | 0.375% | 0.514% | - | 400.00 | 25.00 |

| Clientis Bank Toggenburg | 0.375% | 0.599% | - | 400.00 | 25.00 |

| Crédit Agricole next bank (Suisse) | 0.350% | - | - | 400.00 | - |

| Caisse d'Epargne de Nyon | 0.250% | 0.410% | - | n.a. | n.a. |

| Banque Cantonale de Fribourg | 0.200% | 0.306% | - | 300.00 | 30.00 |

| Glarner Kantonalbank freeME | 0.200% | 0.492% | - | 400.00 | - |

| WIR Bank | 0.150% | 0.243% | - | 300.00 | - |

| Bank CIC (Schweiz) | 0.150% | - | - | 300.00 | - |

| Bank EEK | 0.100% | 0.240% | - | 400.00 | - |

| Bank EKI | 0.100% | 0.217% | - | 400.00 | - |

| Bank Gantrisch | 0.100% | 0.169% | - | 400.00 | - |

| Bank Linth LLB | 0.100% | 0.132% | - | 400.00 | - |

| Bezirks-Sparkasse Dielsdorf | 0.100% | 0.353% | - | 400.00 | - |

| Burgerliche Ersparniskasse Bern | 0.100% | 0.290% | - | 400.00 | 25.00 |

| Regiobank Solothurn | 0.100% | 0.186% | - | 400.00 | n.a. |

| Sparcassa 1816 | 0.100% | 0.231% | - | 400.00 | 25.00 |

| Sparkasse Schwyz | 0.100% | 0.445% | - | 400.00 | 25.00 |

| Thurgauer Kantonalbank (swisscanto) | 0.100% | 0.185% | 36.00 | 400.00 | - |

| Thurgauer Kantonalbank (pens free) | 0.100% | 0.178% | - | 400.00 | - |

| Spar- und Leihkasse Frutigen (rendita) | 0.100% | - | - | 400.00 | - |

| acrevis Bank (Rendite) | 0.050% | 0.186% | - | 400.00 | - |

| AEK BANK 1826 (Rendita) | 0.050% | 0.277% | - | 400.00 | - |

| Alpha RHEINTAL Bank (Privor) | 0.050% | 0.224% | - | 400.00 | 25.00 |

| Alternative Bank Schweiz | 0.050% | 0.053% | 100.00 | 200.00 | 50.00 |

| Appenzeller Kantonalbank | 0.050% | 0.222% | 36.00 | 400.00 | - |

| Bank BSU | 0.050% | 0.191% | - | 400.00 | 25.00 |

| Bank Cler | 0.050% | 0.153% | 36.00 | 300.00 | 20.00 |

| Bank Leerau | 0.050% | 0.179% | - | 400.00 | 25.00 |

| Bank Oberaargau | 0.050% | 0.093% | - | 400.00 | 25.00 |

| Bank Thalwil | 0.050% | 0.163% | 24.00 | 400.00 | - |

| Banque Cantonale du Valais | 0.050% | 0.129% | 36.00 | n.a. | - |

| Banque Cantonale Neuchâteloise | 0.050% | 0.155% | 36.00 | 400.00 | - |

| Basellandschaftliche Kantonalbank | 0.050% | 0.193% | - | 200.00 | k.A. |

| Basler Kantonalbank | 0.050% | 0.199% | 36.00 | 300.00 | 20.00 |

| BBO Bank Brienz Oberhasli | 0.050% | 0.303% | 20.00 | 400.00 | - |

| Berner Kantonalbank | 0.050% | 0.231% | - | 250.00 | 25.00 |

| Clientis Bank im Thal | 0.050% | 0.127% | - | 400.00 | 25.00 |

| Glarner Kantonalbank | 0.050% | 0.063% | 36.00 | 400.00 | - |

| GRB Glarner Regionalbank | 0.050% | 0.292% | 1.00 | n.a. | n.a. |

| Leihkasse Stammheim | 0.050% | 0.199% | - | 400.00 | 25.00 |

| Luzerner Kantonalbank | 0.050% | 0.112% | - | 300.00 | 100.00 |

| Migros Bank | 0.050% | 0.141% | - | 250.00 | - |

| Nidwaldner Kantonalbank | 0.050% | 0.138% | - | 150.00 | 100.00 |

| Obwaldner Kantonalbank | 0.050% | 0.113% | - | 150.00 | 100.00 |

| Raiffeisen Schweiz | 0.050% | 0.330% | - | 250.00 | - |

| Regiobank Männedorf | 0.050% | 0.170% | n.a. | 400.00 | 25.00 |

| Spar- und Leihkasse Bucheggberg (Rendita) | 0.050% | 0.121% | - | 400.00 | - |

| St. Galler Kantonalbank | 0.050% | 0.136% | 36.00 | 400.00 | - |

| UBS | 0.050% | 0.139% | 36.00 | 300.00 | - |

| Urner Kantonalbank | 0.050% | 0.097% | 36.00 | 400.00 | - |

| Valiant Bank | 0.050% | 0.143% | 36.00 | 400.00 | 25.00 |

| Zuger Kantonalbank | 0.050% | 0.133% | - | 200.00 | - |

| Zürcher Landbank | 0.050% | 0.181% | n.a. | 400.00 | 25.00 |

| Clientis EB Entlebucher Bank | 0.020% | 0.109% | - | 400.00 | 25.00 |

| Aargauische Kantonalbank | 0.010% | 0.144% | - | 300.00 | - |

| Baloise Bank | 0.010% | 0.121% | - | 400.00 | - |

| Banque Cantonale de Genève | 0.010% | 0.115% | - | 500.00 | 120.00 |

| Banque Cantonale Vaudoise | 0.010% | 0.095% | - | 400.00 | - |

| Graubündner Kantonalbank | 0.010% | 0.177% | - | 400.00 | - |

| Schaffhauser Kantonalbank | 0.010% | 0.167% | 36.00 | 400.00 | - |

| Schwyzer Kantonalbank | 0.010% | 0.123% | 36.00 | 400.00 | - |

| Zürcher Kantonalbank | 0.010% | 0.111% | - | 200.00 | - |

| Banca dello Stato del Cantone Ticino | 0.000% | 0.140% | 36.00 | 400.00 | - |

| Bank in Zuzwil | 0.000% | 0.120% | - | 400.00 | 25.00 |

| Bank SLM (Privor) | 0.000% | 0.074% | 36.00 | 400.00 | 25.00 |

| BANK ZIMMERBERG | 0.000% | 0.301% | - | 400.00 | - |

| Banque Cantonale du Jura SA | 0.000% | 0.076% | - | n.a. | - |

| Bernerland Bank | 0.000% | 0.144% | 36.00 | 400.00 | 25.00 |

| Biene Bank im Rheintal | 0.000% | 0.197% | 60.00 | 400.00 | 25.00 |

| BS Bank Schaffhausen | 0.000% | 0.141% | - | 400.00 | 25.00 |

| Bank Avera | 0.000% | 0.104% | - | 400.00 | 25.00 |

| Hypothekarbank Lenzburg | 0.000% | 0.112% | - | 400.00 | - |

| PostFinance | 0.000% | 0.084% | 36.00 | 400.00 | - |

| Spar- und Leihkasse Thayngen | 0.000% | 0.128% | - | 400.00 | 25.00 |

| Ersparniskasse Affoltern i.E. | 0.000% | 0.154% | - | 400.00 | 25.00 |

What is the average interest rate?

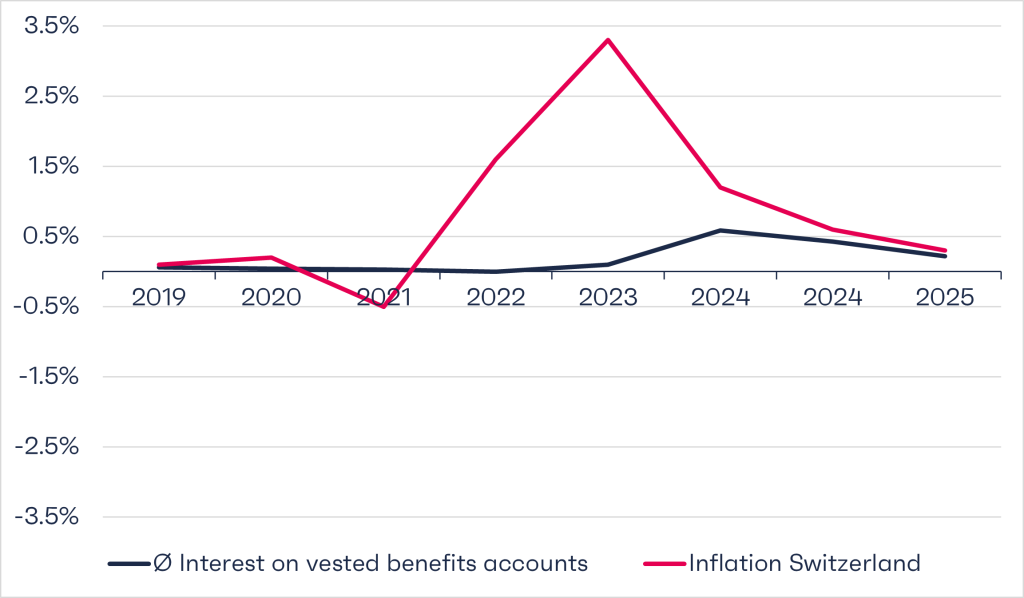

The average interest rate is currently 0.082%. The range of interest rates paid on vested benefits accounts is very wide. It starts at 0% and goes up to 0.5%.

This is more than before, but still not enough. This is because inflation has been higher than the interest on vested benefits accounts since the start of 2022. This means that less can be bought with the money in vested benefits accounts (loss of purchasing power).

The interest on vested benefits accounts is significantly lower than on 3a retirement savings accounts due to the short holding period. If you are interested in a comparison of interest rates for 3a accounts, you can read more in the linked article.

Vested benefits from finpension

Since October 2024, finpension has also been offering a vested benefits account. For greater transparency, our interest rates are linked to the Swiss National Bank’s key interest rate. It only takes a few minutes to open a vested benefits account and switch to finpension.

Is investing an option for you?

Would you like to get more out of your vested benefits? Then the question arises as to whether an investment in securities is an option for your vested benefits account. Once you have clarified this question, we recommend that you compare the offers on the market. We have also drawn up a comparison of pension funds for this purpose.

With the vested benefits from finpension, you can invest vested benefits assets in securities in a broadly diversified manner. The fee is only 0.49 %. It includes the product costs (TER), transaction costs and custody account fees.

Read more: