With this comparison, we want to help you find the best vested benefits account in Switzerland for you. In addition to comparing the interest rates and fees of over 80 providers, you will also find out the average interest rate on a vested benefits account.

Table of content

How do I find the best vested benefits account in Switzerland?

To find the best vested benefits account for you, you can use the following criteria as a guide:

- Interest rate: This is probably one of the most important factors when choosing a vested benefits account. If the interest rate on the vested benefits account is higher, your pension assets will grow faster. It is worth comparing vested benefits accounts on a regular basis, as interest rates often change.

- Fees: In addition to the interest rates, you should also pay attention to the fees. Some providers charge fees for account management or WEF withdrawals. Such fees reduce the growth of your pension assets and can even lead to a loss.

- Flexibility and ease of opening: Another important point is how easily you can open and close the account. As vested benefits accounts are often only held for a short period of time, providers with streamlined processes are a good choice. The processes of digital providers are often the simplest.

The best vested benefits account in terms of interest rate

Four providers share first place on the podium of the best interest payers for vested benefits accounts. Clientis Bank Thur, Clientis Bank Toggenburg, Crédit Agricole next bank and Hypo Vorarlberg pay 1.00 percent interest on the vested benefits account. All other providers pay interest of 0.75 percent or less.

In our comparison of vested benefits accounts, you can compare not only the interest rates, but also the fees for account management, balancing and WEF withdrawals. The fees are only indicative and may vary depending on the conditions. For example, many banks have a rule that the WEF fee is lower if the mortgage is taken out with them. The table can be sorted in any order.

Comparison of interest and fees on vested benefits accounts

| December 2024 | Ø last 5 years | Account Management p.a. | WEF Advance Withdrawal | Cash Out | |

|---|---|---|---|---|---|

| Clientis Bank Thur | 1.000% | 0.490% | - | 400.00 | 25.00 |

| Clientis Bank Toggenburg | 1.000% | 0.631% | - | 400.00 | 25.00 |

| Hypo Vorarlberg (Schweiz) | 1.000% | 1.130% | - | 400.00 | 25.00 |

| Crédit Agricole next bank (Suisse) | 1.000% | 1.000% | - | 400.00 | - |

| BANK ZIMMERBERG | 0.750% | 0.363% | - | 400.00 | - |

| Bezirks-Sparkasse Dielsdorf | 0.750% | 0.383% | - | 400.00 | - |

| Glarner Kantonalbank freeME | 0.750% | 0.633% | - | 400.00 | - |

| BBO Bank Brienz Oberhasli | 0.700% | 0.321% | 20.00 | 400.00 | - |

| Sparkasse Schwyz | 0.700% | 0.680% | - | 400.00 | 25.00 |

| AEK BANK 1826 (Rendita) | 0.600% | 0.340% | - | 400.00 | - |

| Caisse d'Epargne d'Aubonne | 0.550% | 0.483% | 36.00 | k.A. | |

| Caisse d'Epargne de Nyon | 0.550% | 0.433% | - | k.A. | |

| finpension | 0.510% | - | - | 500.00 | - |

| Appenzeller Kantonalbank | 0.500% | 0.298% | 36.00 | 400.00 | - |

| Bank BSU | 0.500% | 0.234% | - | 400.00 | 25.00 |

| Bank EKI | 0.500% | 0.246% | - | 400.00 | - |

| Banque Cantonale de Fribourg | 0.500% | 0.321% | - | 300.00 | 30.00 |

| Berner Kantonalbank | 0.500% | 0.291% | - | 250.00 | 25.00 |

| GRB Glarner Regionalbank | 0.500% | 0.442% | k.A. | k.A. | k.A. |

| Bank CIC (Schweiz) | 0.500% | 0.775% | - | 300.00 | - |

| Basler Kantonalbank | 0.450% | 0.248% | 36.00 | 300.00 | 20.00 |

| Graubündner Kantonalbank | 0.450% | 0.248% | - | 400.00 | - |

| Alpha RHEINTAL Bank (Privor) | 0.400% | 0.290% | - | 400.00 | 25.00 |

| Bank Cler | 0.400% | 0.194% | 36.00 | 300.00 | 20.00 |

| Bank EEK | 0.400% | 0.233% | - | 400.00 | - |

| Bank Thalwil | 0.400% | 0.228% | 24.00 | 400.00 | - |

| Basellandschaftliche Kantonalbank | 0.400% | 0.261% | - | 200.00 | k.A. |

| Biene Bank im Rheintal | 0.400% | 0.229% | 60.00 | 400.00 | 25.00 |

| Burgerliche Ersparniskasse Bern | 0.400% | 0.317% | - | 400.00 | 25.00 |

| Caisse d'Epargne de Cossonay | 0.400% | 0.228% | - | 400.00 | 25.00 |

| Leihkasse Stammheim | 0.400% | 0.248% | - | 400.00 | 25.00 |

| Raiffeisen Schweiz | 0.400% | 0.550% | - | 250.00 | - |

| Regiobank Männedorf | 0.400% | 0.222% | k.A. | 400.00 | 25.00 |

| Regiobank Solothurn | 0.400% | 0.232% | - | 400.00 | k.A. |

| Schaffhauser Kantonalbank | 0.400% | 0.242% | 36.00 | 400.00 | - |

| Sparcassa 1816 | 0.400% | 0.252% | - | 400.00 | 25.00 |

| WIR Bank | 0.400% | 0.306% | - | 300.00 | - |

| Spar- und Leihkasse Frutigen (rendita) | 0.400% | 0.520% | - | 400.00 | - |

| Thurgauer Kantonalbank (swisscanto) | 0.350% | 0.241% | 36.00 | 400.00 | - |

| Thurgauer Kantonalbank (pens free) | 0.350% | 0.230% | - | 400.00 | - |

| acrevis Bank (Rendite) | 0.300% | 0.243% | - | 400.00 | - |

| Bank in Zuzwil | 0.300% | 0.167% | - | 400.00 | 25.00 |

| Bank Leerau | 0.300% | 0.245% | - | 400.00 | 25.00 |

| Banque Cantonale Neuchâteloise | 0.300% | 0.208% | 36.00 | 400.00 | - |

| Banque Cantonale Vaudoise | 0.300% | 0.139% | 400.00 | - | |

| Banque Cantonale Vaudoise (avenirplus) | 0.300% | 0.139% | 36.00 | 500.00 | 50.00 |

| BS Bank Schaffhausen | 0.300% | 0.202% | - | 400.00 | 25.00 |

| Clientis Zürcher Regionalbank | 0.300% | 0.151% | - | 400.00 | 25.00 |

| Credit Suisse | 0.300% | 0.172% | 36.00 | 400.00 | k.A. |

| Migros Bank | 0.300% | 0.179% | - | 250.00 | - |

| Nidwaldner Kantonalbank | 0.300% | 0.174% | - | 150.00 | 100.00 |

| Spar- und Leihkasse Bucheggberg (Rendita) | 0.300% | 0.158% | - | 400.00 | - |

| Spar- und Leihkasse Thayngen | 0.300% | 0.180% | - | 400.00 | 25.00 |

| UBS | 0.300% | 0.171% | 36.00 | 300.00 | - |

| Valiant Bank | 0.300% | 0.189% | 36.00 | 400.00 | 25.00 |

| VIAC | 0.300% | 0.360% | - | 300.00 | - |

| Zürcher Landbank | 0.300% | 0.230% | k.A. | 400.00 | 25.00 |

| Bank Avera | 0.300% | 0.260% | - | 400.00 | 25.00 |

| Banca dello Stato del Cantone Ticino | 0.250% | 0.178% | 36.00 | 400.00 | - |

| Banque Cantonale de Genève | 0.250% | 0.222% | - | 500.00 | 120.00 |

| Banque Cantonale du Valais | 0.250% | 0.164% | 36.00 | k.A. | - |

| Bernerland Bank | 0.250% | 0.240% | 36.00 | 400.00 | 25.00 |

| Aargauische Kantonalbank | 0.200% | 0.209% | - | 300.00 | - |

| Alternative Bank Schweiz | 0.200% | 0.022% | 100.00 | 200.00 | 50.00 |

| Baloise Bank SoBa | 0.200% | 0.172% | - | 400.00 | - |

| Bank Gantrisch | 0.200% | 0.193% | - | 400.00 | - |

| Bank Linth LLB | 0.200% | 0.131% | - | 400.00 | - |

| Luzerner Kantonalbank | 0.200% | 0.126% | - | 300.00 | 100.00 |

| Obwaldner Kantonalbank | 0.200% | 0.138% | - | 150.00 | 100.00 |

| Schwyzer Kantonalbank | 0.200% | 0.154% | 36.00 | 400.00 | - |

| St. Galler Kantonalbank | 0.200% | 0.177% | 36.00 | 400.00 | - |

| Zuger Kantonalbank | 0.200% | 0.171% | - | 200.00 | - |

| Zürcher Kantonalbank | 0.200% | 0.149% | - | 200.00 | - |

| frankly | 0.200% | - | - | - | - |

| Clientis Bank im Thal | 0.150% | 0.161% | - | 400.00 | 25.00 |

| Clientis EB Entlebucher Bank | 0.150% | 0.148% | - | 400.00 | 25.00 |

| Hypothekarbank Lenzburg | 0.150% | 0.159% | - | 400.00 | - |

| Ersparniskasse Affoltern i.E. | 0.150% | 0.225% | - | 400.00 | 25.00 |

| Bank Oberaargau | 0.100% | 0.104% | - | 400.00 | 25.00 |

| Banque Cantonale du Jura SA | 0.100% | 0.127% | - | k.A. | - |

| Glarner Kantonalbank | 0.100% | 0.054% | 36.00 | 400.00 | - |

| PostFinance | 0.100% | 0.137% | 36.00 | 400.00 | - |

| Urner Kantonalbank | 0.100% | 0.128% | 36.00 | 400.00 | - |

| Bank SLM (Privor) | 0.000% | 0.00 | 36.00 | 400.00 | 25.00 |

| Bank SLM (avenirplus) | 0.000% | 0.123% | - | 500.00 | 50.00 |

What is the average interest rate?

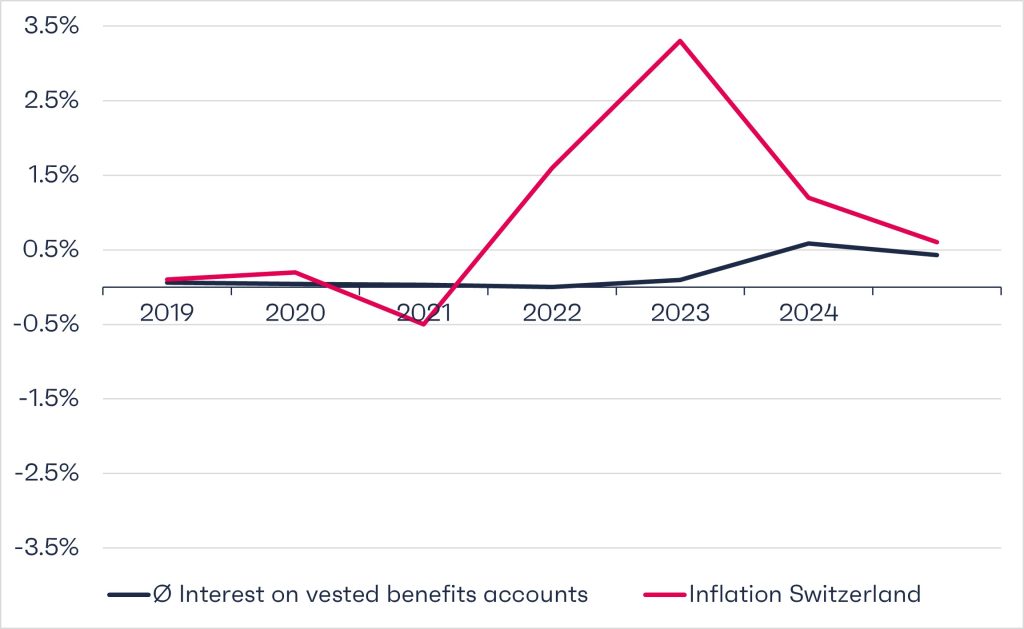

The average interest rate is currently 0.37 percent. The range of interest rates paid on vested benefits accounts is very wide. It starts at 0 percent and goes up to 1.00 percent.

This is more than before, but still not enough. This is because inflation has been higher than the interest on vested benefits accounts since the start of 2022. This means that less can be bought with the money in vested benefits accounts (loss of purchasing power).

After all, negative interest on vested benefits accounts is not permitted, as you can read in the expert opinion commissioned by the federal government (the expert opinion was drawn up in French).

The interest on vested benefits accounts is significantly lower than on 3a retirement savings accounts due to the short holding period. If you are interested in a comparison of interest rates for 3a accounts, you can read more in the linked article.

Vested benefits foundation from finpension

Since October 2024, finpension has also been offering a vested benefits account. For greater transparency, our interest rates are linked to the Swiss National Bank’s key interest rate. It only takes a few minutes to open a vested benefits account and switch to finpension.

Is investing an option for you?

Would you like to get more out of your vested benefits? Then the question arises as to whether an investment in securities is an option for your vested benefits account. Once you have clarified this question, we recommend that you compare the offers on the market. We have also drawn up a comparison of pension funds for this purpose.

With the finpension Vested Benefits Foundation, you can invest vested benefits assets in securities in a broadly diversified manner. The fee is only 0.49 %. It includes the product costs (TER), transaction costs and custody account fees.

Read more: