No, unfortunately this is not possible. You cannot pay into pillar 3a retrospectively. This means that you cannot make up for missed payments from previous years, as it is possible in the pension fund with voluntary purchases. You can only ever pay into Pillar 3a for the current year, and only the maximum amount set by the Federal Council.

Political proposal by Councillor of States Ettlin wants to enable retrospective 3a purchase

Erich Ettlin, representative of the Canton of Obwalden in the Council of States, submitted a motion (DE, FR, IT) on 19 June 2019 calling for this rule to be changed. He wants subsequent purchases to be possible in pillar 3a as well. He proposes the following rules:

- You must have earned income subject to AHV at the time of the subsequent 3a purchase.

- No income from employment subject to AHV is required for earlier years. It is therefore also possible to make a retrospective payment for a year without earned income.

- A retrospective 3a purchase is only possible every five years.

- A retrospective 3a purchase is limited to the large 3a deduction of currently CHF 34,416 per case.

- All advance withdrawals for home ownership are deducted from the purchase potential.

In the year of purchase, one should be able to make the ordinary 3a deposit in addition to the purchase and deduct it for tax purposes.

Calculation of the maximum retrospective payment into pillar 3a

The maximum amount that you are allowed to pay into pillar 3a retrospectively is calculated as follows (example person born in 1974):

| Largest possible Pillar 3a payments with year of birth 1974 | CHF 177’038 |

| Assumption of current 3a credit balance (3a deposit for 2021 already included) | CHF 30’000 |

| Acceptance of advance withdrawals for residential property | CHF 50’000 |

| Pillar 3a pension gap | CHF 97’038 |

| Maximum 3a purchase in 2021 (due to the restriction to the large 3a maximum amount) | CHF 34’416 |

Is the new rule coming and when does it apply?

Whether the new rule will ever come into force is uncertain. Although both chambers approved Erich Ettlin’s motion – the motion was not uncontroversial:

- Council of States (DE, FR) on 12 September 2019: approved by 20 votes to 13

- National Council (DE, FR) on 2 June 2020: approved by 112 votes to 70

Criticism comes especially from left-wing circles. It is seen as a concern, that only the rich would profit from these changes.

On 22 November, the Federal Council submitted the report for consultation. It appears that the amendment will be possible without revising the corresponding Article 82 of the Occupational Pensions Act and will be adopted by the Federal Council by ordinance. This means that no referendum or popular vote is possible. It therefore depends solely on whether the amendment to the ordinance is passed by the Federal Council. But first, the consultation process is now underway. It ends on 6 March 2024.

What is our opinion?

The idea is not new that one could enable purchases in Pillar 3a. In principle, we think the proposal is good. However, when calculating the 3a purchase potential, one must be aware that there will be unequal treatment of 3a accounts and 3a deposits.

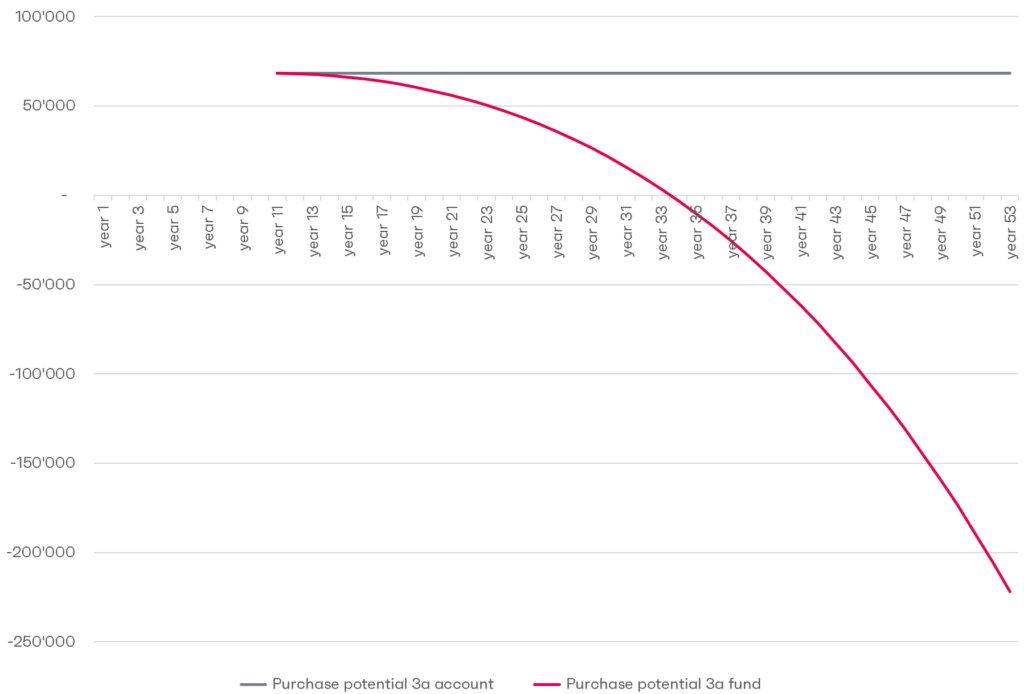

Let’s make an example with two people, a woman and a man. Both do not pay into pillar 3a for the first 10 years, but after that they regularly pay the maximum amount.

- The man leaves the money in a 3a account.

- The woman invests the money in 3a equity funds

With the proposed calculation of the purchase potential, the woman would be penalised for investing the funds profitably. Her purchase potential would drop to 0 francs within 25 years even without a subsequent 3a purchase – wiped out by the performance of the 3a fund (assumption 3 % p.a.).

The man who leaves the money in the 3a account would be rewarded for his risk aversion by being able to pay more into the pillar 3a retrospectively than the woman and therefore being able to deduct more from his taxes.

In the second pillar, the purchase potential is compounded for this reason. However, this is hardly feasible in pillar 3a.