Conversion loss

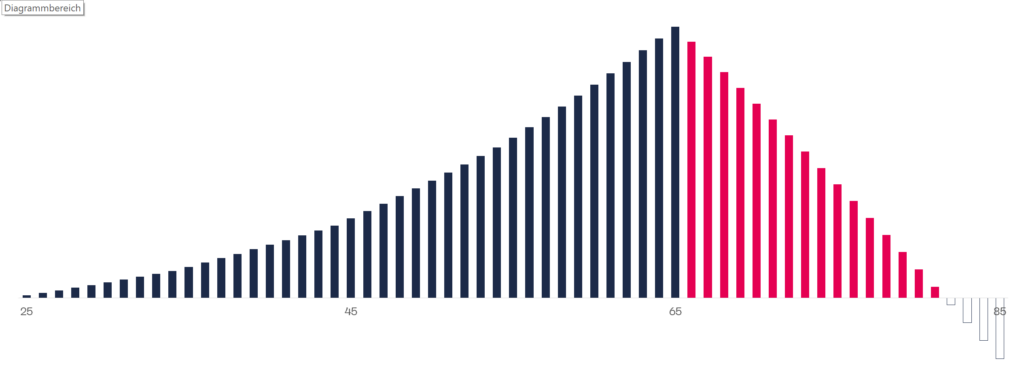

The conversion loss arises when the accumulated old-age savings in the BVG obligation are converted into a pension. In this case, the statutory minimum conversion rate of 6.8 percent is applied. This means that an annual pension of CHF 6,800 results from a retirement capital of CHF 100,000, for example. Accordingly, the capital is used up after 14.7 years. However, the average remaining life expectancy from the time of retirement is 19.9 years for men and 23.7 years for women (2018), with a slight upward trend. The retirement assets are therefore not sufficient to cover pension payments until the end of life. A loss is inevitable.

If the asset (red) can be invested profitably beyond the retirement date, which pension funds can do thanks to the collective investment strategy, the conversion loss can be reduced. However, in order to eliminate the conversion loss completely, an annual return of around 4% must be achieved, which in the current interest rate environment is only possible if high risks are taken (see BVG minimum interest rate). The risks, in turn, are borne only by the employees, since the pensions are guaranteed.

The conversion losses in the BVG obligation are cross-financed by lower interest on the retirement assets and by poorer benefits in the supplementary obligation. There is a redistribution from the active insured to the pensioners.