Reporting for the lump-sum tax credit for withholding taxes on US dividends

Based on data from Blackrock – the company behind iShares – we have developed reporting that should allow you to reclaim more withholding tax on US dividends than ever before.

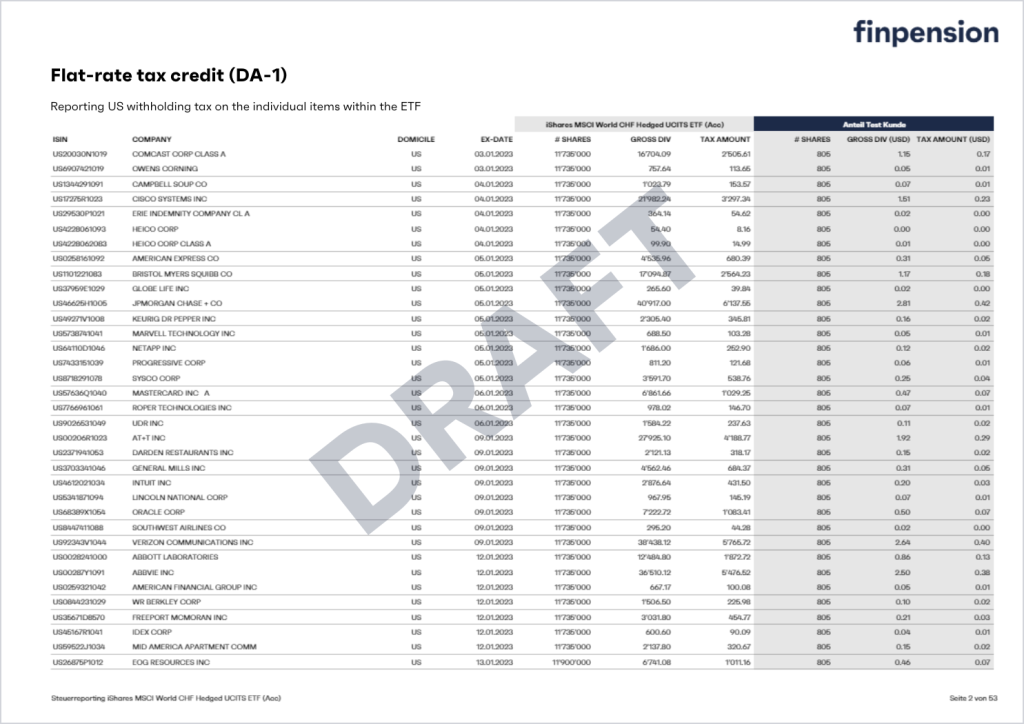

At the beginning of 2025, we will provide our clients with a withholding tax deduction of more than CHF 100 (subject to invested assets of around CHF 50,000 or more) with this new type of reporting for the lump-sum tax credit for US dividends for the first time. It looks like this:

- The overview page contains all the information for the transfer to form DA-1.

- All dividend payments received by the fund(s) in the relevant tax period are listed on the following pages. This information allows the tax authorities to check the requested flat-rate tax credit for each individual item if necessary.

We would like to offer reporting for all funds with a large proportion of US investments. This includes the following funds:

- iShares Core S&P 500 UCITS ETF (IE00B5BMR087)

- iShares S&P 500 CHF Hedged UCITS ETF (Acc) (IE00B88DZ566)

- iShares NASDAQ 100 UCITS ETF USD (Acc) (IE00B53SZB19)

- iShares MSCI USA ESG Enhanced UCITS ETF USD (IE00BHZPJ908)

- iShares S&P 500 Paris-Aligned Climate UCITS ETF USD (IE00BMXC7V63)

- iShares Developed Markets Property Yield UCITS ETF USD (Dist) (IE00B1FZS350)

Thanks to this new type of reporting, you should also be able to reclaim the 15 percent withholding tax on US securities, which is normally lost even if the fund is domiciled in Ireland. With a dividend yield of two percent, this corresponds to a performance advantage of 0.30 percent on the US share you hold.

15 % withholding tax * 2 % dividend yield = 0.30 % performance advantage

(on the individual US share in your portfolio at finpension)

Do pioneering work with us!

We have currently received positive feedback from the canton of Lucerne that finpension’s new type of reporting is accepted for the flat-rate tax credit. We have been in contact with various other tax authorities for some time and are also trying to work towards a favourable decision. Although these decisions are still pending, we will provide our customers with reporting for the 2024 tax year for the first time at the beginning of 2025.

We assume that the Federal Tax Administration will comment on this sooner or later and that a standardised practice will then also be established among the cantonal tax authorities. If this is not yet the case in spring 2025, we will nevertheless encourage our customers to use the reporting as an enclosure to the DA-1 form of the 2024 tax return and thus emphasise the urgency of a uniform decision.

We are convinced that our reporting fulfills all the requirements for the flat-rate tax credit for withholding taxes on US dividends (see our legal assessment in the last section of this page) and that a rejection of the flat-rate tax credit with our reporting by the tax authorities would not stand up to a judicial assessment. Nevertheless, we cannot offer any guarantee in this regard.

At least 100 francs per tax year

Please note that the lump-sum tax credit is only possible if it amounts to more than CHF 100 for the tax year in question. However, the question of whether you reach CHF 100 can also take into account lump-sum tax credits from other securities income and not only those from finpension. We therefore also issue the report to customers for whom the lump-sum tax credit for finpension is less than CHF 100.

Elimination of withholding tax on US dividends in two steps

Step 1: From 30 to 15 % thanks to fund domicile Ireland

Anyone who invests money in the stock markets practically cannot avoid the USA. The USA accounts for almost 65 percent of the MSCI All-Country World Index. Accordingly, the question of what taxes Swiss investors pay on the income from US securities is an important one.

The answer to this question basically depends on whether you invest directly in US securities or indirectly via a fund domiciled outside the USA. Although a direct investment in US funds is interesting from a tax perspective and is also possible via good brokers, it is not recommended across the board because it entails other tax risks (keyword: US inheritance tax).

For this reason, Swiss asset managers do not generally offer their clients direct investments in US securities. Even with finpension’s investment solution, the US market is not mapped via US funds, but via funds domiciled in Ireland. Ireland has a unique double taxation agreement with the USA, which reduces the US withholding tax on dividends by 50 percent (from 30 % to 15 %).

Step 2: From 15 % to 0 % thanks to new unique tax reporting from finpension

The remaining 15 percent of the withholding tax on US dividends, which cannot be reclaimed even by funds domiciled in Ireland, can be claimed in Switzerland via the flat-rate tax credit.

The lump-sum tax credit can be used to reduce the tax liability, as is the case when reclaiming Swiss withholding tax. However, the lump-sum tax credit must be claimed using a separate DA-1 form.

And this is where the crux of the matter begins. In order to be able to claim the flat-rate tax credit, the non-recoverable portion of the withholding tax must be listed for each individual US security. Because a fund can quickly invest in several hundred US securities, it was previously practically impossible for private investors to claim the remaining 15 percent of US withholding tax.

But this is precisely where finpension’s new tax reporting comes into play. This lists the withholding tax that could not be reclaimed by the fund for all US positions held in the fund. Thanks to finpension’s tax reporting, it is now possible for the first time to reclaim the other 15 percent.

Our legal judgment

According to the Ordinance on the Crediting of Foreign Withholding Taxes, a lump-sum tax credit can be applied for withholding taxes on foreign income (Art. 2 para. 1). The aim of the lump-sum tax credit is to avoid double taxation of income in two countries (in our case in the USA by means of withholding tax and in Switzerland as income tax).

Prerequisite:

- The income for which a lump-sum tax credit is requested must be declared gross (see Art. 3 para. 2 of the Ordinance).

- Information on the amount of withholding tax deducted on foreign income must be made available to the tax authorities (see Art. 16 of the Ordinance and Art. 48-50 of the VStG).

«Look through»

Although the fund is actually the recipient of the US dividends, the income from Swiss collective investment schemes is attributable to the individual investor on a pro-rata basis in accordance with Article 10 paragraph 2 of the Federal Direct Tax Act. In this context, the tax authorities speak of transparent funds. In English, one would speak of “look through”. In other words, from a tax perspective, you look through the fund as if it did not exist. The reason for this approach is that the fund itself is not a taxable entity, i.e. it is not subject to income and wealth tax, which of course makes sense, otherwise the income would be taxed twice (once by the fund and once by the investor).

According to circular no. 25 on the taxation of collective investment schemes and their investors, foreign collective investment schemes are also treated as Swiss collective investment schemes for tax purposes under certain conditions (see page 16). The funds used by finpension fulfill these conditions.