“Pension or lump-sum” is the mother of all questions when it comes to planning the retirement. This article shall show you that pension withdraw often means a significant additional tax burden and that a lump-sum withdrawal is therefore more interesting from a tax perspective.

Management Summary

The results of our calculations are very similar for all cantons of Switzerland:

- With a very low basic income of around CHF 25,000 per year, the tax burden on the monthly pension is only marginally higher than that on the capital withdrawal.

- In the canton of Zurich, pension taxation is even lower for low basic incomes. However, the reduction of the capital withdrawal tax in the canton of Zurich will change this and the two variants will then be almost equal for low incomes.

- From a tax perspective, withdrawing a pension is unattractive if the basic income is also high in retirement. The pension will then fall into a high progression bracket.

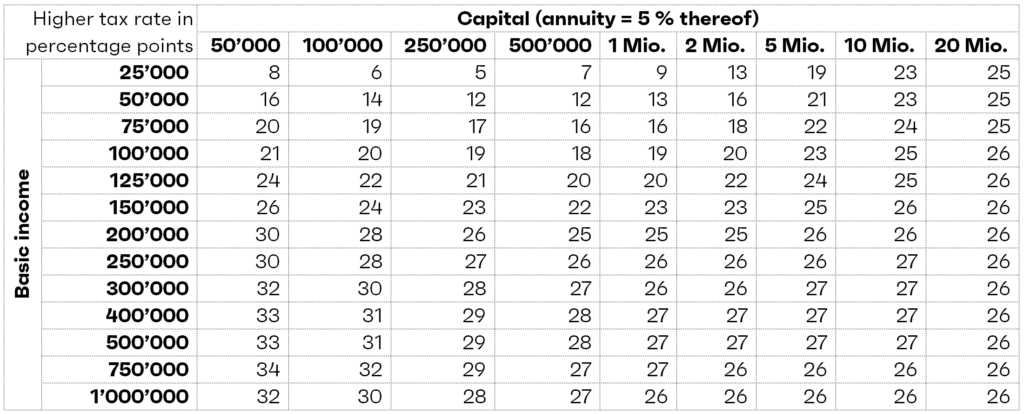

Geneva is an example of how it looks like in most cantons. Higher basic incomes consistently result in a significant additional tax burden on the pension option:

Additional tax burden on pension compared to lump-sum withdrawal in percentage points (GE, Geneva)

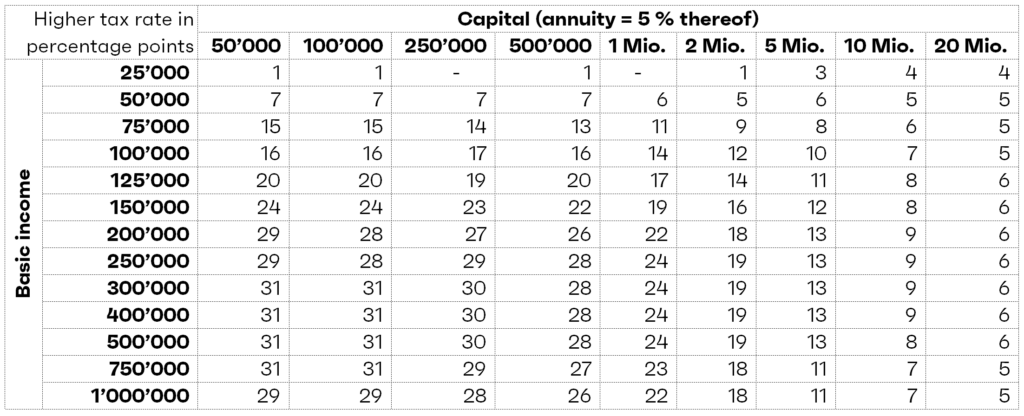

In contrast to the other cantons, the two cantons of Switzerland Ticino and Zurich also have a very strong progression on the capital withdrawal tax. As a result, the tax advantage of a capital withdrawal in these two cantons decreases as the amount of the capital withdrawal increases.

Zurich as an example with high progression in capital withdrawal tax, which reduces the additional burden of the pension option for very high capital withdrawals:

Different taxation of annuity and lump sum

Annuities are considered as income

Annuity payments are considered as normal income. They must be declared in the tax return and are added to taxable income. The income tax rate is applied. This is progressive. This means the higher your income, the more you pay in taxes, not only in francs and centimes, but also as a percentage.

Lump sum is taxed separately

A lump sum withdrawal is taxed separately from other income. There are various methods of calculating the capital gains tax. What they all have in common is that the tax rate is lower than that for income. Like income tax, capital gains tax is progressive. There are a few cantons that levy the tax on the basis of a fixed percentage. But there is also the federal tax, which is progressive.

Comparison of the tax burden for annuity or lump sum

We proceeded as follows in calculating the tax burden of the two variants:

- First, we calculated how much income tax one has to pay for an annual pension between 2,500 and 1 million francs. Because income tax is progressive, we have made this calculation for a basic taxable income between 25,000 and 1 million francs.

- Then we calculated the tax paid on the lump sum withdrawal between 50,000 and 20 million francs, i.e. on 20 times the above pension (assumption of pension conversion rate: 5%).

- After that, we calculated the wealth tax. Since the money withdrawn falls into private assets after a lump-sum withdrawal, it must be taxed as assets. When calculating the wealth tax, we reduced the assets from the capital withdrawal to 0 francs on a straight-line basis over 20 years.

- Finally, we calculated the difference between the income tax in % and the capital gains tax (incl. wealth tax) in %.

Die Bandbreiten der einzelnen Kantone finden Sie etwas weiter unten. Zuerst aber zwei Beispielrechnungen, die das The bandwidths of the individual cantons can be found a little further down. But first, two sample calculations that make what I have just said a little more tangible.

Sample calculations

Sample 1:

Man, not married, non-denominational and without children, living in Zurich (basic taxable income 50,000 francs, pension 5,000 francs vs. lump-sum withdrawal 100,000 francs):

| Tax rate on the annuity | Tax rate on the lump sum | Additional tax burden on the annuity | |

| Income tax | 18 % | – | |

| Capital gains tax | – | 5 % | |

| Wealth tax* | – | 6 % | |

| Total | 18 % | 11 % | 7 Percentage points |

*Wealth tax in the case of high taxable wealth. In the case of low taxable wealth, the wealth tax may be lower, provided that the wealth tax in the canton concerned is progressive.

Sample 2:

Man, not married, non-denominational and without children, living in Zug (basic taxable income 200,000 francs, pension 50,000 francs vs. capital withdrawal 1,000,000 francs):

| Tax rate on the annuity | Tax rate on the lump sum | Additional tax burden on the annuity | |

| Income tax | 24 % | – | |

| Capital gains tax | – | 6 % | |

| Wealth tax* | – | 3 % | |

| Total | 24 % | 9 % | 15 Percentage points |

*Wealth tax in the case of high taxable wealth. In the case of low taxable assets, the wealth tax may be lower, provided that the wealth tax in the canton concerned is progressive.

Bandwidth of the additional pension burden by canton

| Canton | Additional tax burden on the pension in percentage points (With taxable basic income from 25,000 francs) |

| AG, Aarau | 3 – 28 |

| AI, Appenzell | 6 – 21 |

| AR, Herisau | 4 – 23 |

| BE, Bern | 7 – 34 |

| BL, Liestal | 5 – 34 |

| BS, Basel | 6 – 28 |

| FR, Fribourg | 4 – 33 |

| GE, Genève | 5 – 34 |

| GL, Glarus | k. A. |

| GR, Chur | 7 – 28 |

| JU, Delémont | 7 – 32 |

| LU, Luzern | 10 – 29 |

| NE, Neuchâtel | 18 – 36 |

| NW, Stans | 8 – 23 |

| OW, Sarnen | 6 – 19 |

| SG, St. Gallen | 10 – 27 |

| SH, Schaffhausen | 5 – 31 |

| SO, Solothurn | 3 – 32 |

| SZ, Schwyz | 3 – 25 |

| TG, Frauenfeld | 8 – 25 |

| TI, Bellinzona | 9 – 38 |

| UR, Altdorf | 7 – 21 |

| VD, Lausanne | 1 – 36 |

| VS, Sion | k. A. |

| ZG, Zug | 0 – 20 |

| ZH, Zürich | -5 – 31 |

Notes to the conclusion

Consider the options of staggered withdrawal of pension benefits.

If the capital is withdrawn and invested, the income must be taxed as income. We have not taken these income taxes on possible returns into account in the calculations. We recommend that the expected returns (less income tax) be included in the assessment of the attractiveness of the pension conversion rate (pension vs. capital consumption in private assets).

Several capital withdrawals in the same year are counted together (also from jointly assessed partners). Since the capital withdrawal tax is progressive, the tax rate on the capital withdrawal increases as a result. However, since a joint pension withdrawal also leads to a higher progression, the statements made are in principle also applicable to married persons.

The tax burden is only one of many aspects that should be taken into account when assessing the question ” annuity or lump sum”. Others are, for example, the pension conversion rate, i.e. the amount of the pension in relation to the lump sum, your experience in investing any lump sum withdrawal in a yield-oriented manner and your state of health.