No, unfortunately this is not possible. You cannot pay into pillar 3a retroactively. Late payments cannot be backdated to the previous year.

In general, missed payments from previous years cannot currently be made up, as is possible in the pension fund with voluntary purchases. You can only pay into the 3rd pillar for the current year, i.e. the maximum amount set by the Federal Council.

However, there is a political initiative that is intended to enable retrospective payments. We take a closer look at this in this article.

Contents

- 22.11.2023: Proposed amendment to the ordinance by the Federal Council is complicated (and illegal?)

- 19.01.2019: Political initiative by Council of States member Ettlin wants to enable retroactive 3a purchase

22.11.2023: Proposed amendment to ordinance by the Federal Council bureaucratic (and illegal?)

On 22 November, the Federal Council submitted the amendment to the ordinance (BVV 3) for consultation. The consultation will run until 6 March 2024. In this section, we discuss the solution proposed by the Federal Council.

What is the Federal Council’s solution?

First of all, if the amendment to the ordinance were to enter into force on 1 January 2025, a retroactive payment (purchase) would be possible for the first time in 2026 for the year 2025. This is because retrospective payments in years prior to the amendment to the ordinance should not be possible. This is why we are not starting our chart until 1 January 2025.

The other provisions are:

- In order for a purchase potential to exist, there must have been earned income subject to AHV contributions in the year in question. In other words: you would have been allowed to pay into pillar 3a, but you did not, or at least not in full (see the year 2030 in the chart).

- Subsequent payments are limited to the past ten years.

- In the year in which you wish to make a subsequent payment, the ordinary maximum contribution must be fully utilised. This makes it more difficult to fill in the gap years that would fall outside the 10-year observation period in the following year, even if you cannot pay in the maximum contribution in the current year.

- Only one subsequent payment per gap year is possible. However, several gap years can be closed at once with one payment. The Federal Council justifies this restriction with the high additional expense that multiple payments for the same gap year would entail. As if it were not otherwise a high additional expense, but more on this in the next chapter.

- The amount of a subsequent purchase is limited to the maximum contribution to the small pillar 3a. This means that the maximum amount that can be paid in one year is the ordinary maximum contribution plus an additional contribution in the form of a subsequent payment in the amount of the maximum contribution of the small pillar 3a. This also applies to self-employed persons who are not affiliated to a pension fund and can normally pay into the large pillar 3a. For them too, the small maximum contribution is the limit for subsequent payments.

- As soon as a withdrawal is made from the third pillar as part of retirement, which is possible up to five years before reaching the statutory reference age, no further subsequent payments are permitted.

What do we make of this?

The proposal is not really attractive, that is clear and not surprising. At the time, the Federal Council recommended that parliament reject the political proposal. It also has to make savings and new tax privileges are not going to help.

Apart from this, a concept is nevertheless recognisable. By simply looking at the individual years to see whether or not the payment potential has been utilised in the corresponding year, there is no need for a regulation to take into account early withdrawals for home ownership. The latter would have been necessary in Council of States member Ettlin’s proposal because the current 3a credit balance would have been compared with the maximum possible credit balance in order to determine the purchase gap.

However, if you take a closer look, you will see that the Federal Council’s proposal also has its pitfalls. This is because the pension fund member must apply to the pension foundation for a subsequent payment and provide the following information:

- The amount of the requested deposit;

- The years for which a gap is to be filled and the amount of the desired subsequent payment per year;

- The amount of the ordinary payments for the years applied for, stating the payment date.

1st weakness of the proposal: Very few pension fund members will be able to provide information on the regular payments in the years applied for (stating the payment date). For insured persons who only have one 3a provider, the data can be provided by the provider. However, if an insured person has several 3a relationships with different providers, this is not possible and the insured person must make the enquiries themselves. This makes subsequent deposits very unattractive. Accountholders who are with several providers are at a disadvantage.

Furthermore, the beneficiary must confirm that he or she:

- has already paid a full maximum contribution in the current year;

- has not yet made a subsequent payment for the years applied for;

- Has not yet drawn a retirement benefit.

2nd weakness of the proposal: Although, according to the Federal Council’s press release, purchases should be made according to the principle of self-declaration, the Federal Council makes the pension foundations responsible: “Before the institution accepts a subsequent payment, it must check this information and obtain further information from the person making the payment if there are doubts about its legality.” It is of no use if the report states that it is the task of the tax authorities to check the legality.

This is because it still means that the information provided by the insured person must be verified by the providers. If someone changes pension fund, the data on regular and subsequent payments would have to be forwarded to the new provider in future. Finally, this data must be correctly recorded and stored by the new pension fund in its system. With more than 100 pension foundations and insurance companies offering 3a products in Switzerland, we are realistic enough to say that this will not work, or if it does, then only with poor data quality.

Centralised data storage (or a standardised interface for data exchange), which could alleviate such a problem, is unfortunately still a long way off. As a consequence, the solution proposed by the Federal Council leads to significantly higher administrative costs when switching providers, which are not in good proportion to the rather smaller amounts in pillar 3a.

Lack of legal legitimisation

The Federal Council’s amendment to the ordinance is based on Article 82 of the Occupational Pensions Act. It states that the Federal Council, together with the cantons, determines the deductibility of contributions for Pillar 3a.

The question now is whether “contributions” also refers to subsequent payments into pillar 3a or not. In order to answer this question, it is necessary to analyse the intention of the legislator.

The first Occupational Pensions Act (BVG) dates back to 25 June 1982 and came into force on 1 January 1985. This first version of the BVG did not provide for the possibility of paying in missed contributions retrospectively, neither for the second nor for the third pillar. However, Article 82 of the Occupational Pension Act already existed. It was exactly the same as it is today: the Federal Council, together with the cantons, determines the deductibility of contributions to pillar 3a. As there were no subsequent contributions, the legislator could not have meant anything other than annual contributions.

With the introduction of the Vested Benefits Act (FZG) of 17 December 1993 (entry into force on 1 January 1995), a possibility for voluntary buy-ins was created. Article 9 states that the pension funds must allow insured persons to buy in up to their full regulatory benefits. However, voluntary purchases clearly only apply to the second pillar. Article 79b on voluntary purchases in the Occupational Pensions Act is also based on this Article 9 in the Vested Benefits Act. Article 82 BVG, on which the Federal Council is basing the amendment to the ordinance, has never changed. From this it can be deduced that the original idea still applies that only the annual payments into Pillar 3a are meant by “contributions”, which the Federal Council can determine together with the cantons.

In our opinion, the Federal Council is therefore not authorised to introduce subsequent payments into pillar 3a by ordinance. This would require a revision of the law.

Political debate cancelled out

The question of whether a revision of the law is necessary is relevant for two reasons. Firstly, because of the principle of legality, which states that the Federal Council and the authorities may only act within the law. Secondly, because a revision of the law is subject to a referendum, unlike amendments to ordinances.

In our view, it would be important for subsequent payments into pillar 3a to be enshrined in law and, if politically necessary, approved by the electorate in a referendum. It is well known that subsequent payments into pillar 3a are not uncontroversial.

19.01.2019: Political initiative by Council of States member Ettlin wants to enable retroactive 3a purchase

Erich Ettlin, representative of the canton of Obwalden in the Council of States, submitted a motion on 19 June 2019 calling for this rule to be changed. He wants retrospective purchases to also be possible in pillar 3a. He proposes the following rules:

- You must have earned income subject to AHV contributions at the time of the subsequent 3a purchase .

- No earned income subject to AHV contributions is required for earlier years. It is therefore also possible to make an additional payment for a year without earned income.

- A subsequent 3a purchase is only possible every five years.

- A subsequent 3a purchase is limited each time to the large 3a deduction of currently CHF 34,416.

- All advance withdrawals for residential property are deducted from the purchase potential.

In the year of purchase, you should be able to make the ordinary 3a payment in addition to the purchase and deduct it for tax purposes.

Calculation of the maximum subsequent payment into pillar 3a

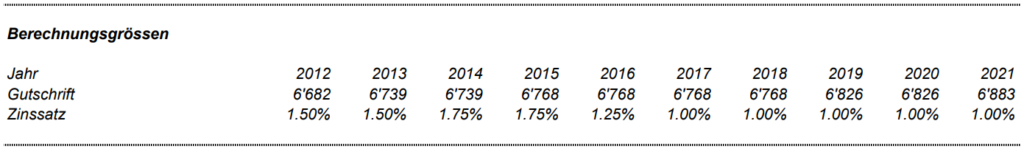

The maximum amount that can be paid into pillar 3a retrospectively is calculated as follows (example of a person born in 1974):

| Largest possible pillar 3a payments for those born in 1974 | CHF 177,038 |

| Assumption of current 3a assets (3a payment for 2021 already included) | CHF 30’000 |

| Assumption of advance withdrawals for residential property | CHF 50,000 |

| Pension gap in pillar 3a | CHF 97’038 |

| Maximum 3a purchase in 2021 (due to the restriction to the large 3a maximum amount) | CHF 34’416 |

Is the new rule coming and when will it apply?

It is uncertain whether the new rule will ever come into force. Although both chambers voted in favour of Erich Ettlin’s motion – the motion was not uncontroversial:

- Council of States on 12 September 2019: approved by 20 votes to 13

- National Council on 2 June 2020: approved by 112 votes to 70

Criticism is coming from left-wing circles in particular. The rich in particular are seen to benefit from this.

What is our opinion on this?

The idea of enabling purchases in pillar 3a is not new. It is based on a demand made by the Swiss Pension Fund Association in 2018.

In principle, we think the proposal is a good one. However, when calculating the 3a buy-in potential, we must be aware that there is unequal treatment of 3a accounts and 3a custody accounts.

Let’s take an example with two people, a woman and a man. Both do not pay into pillar 3a for the first 10 years, but then regularly pay in the maximum amount.

- The man leaves the money in a 3a account.

- The woman invests the money in 3a equity funds.

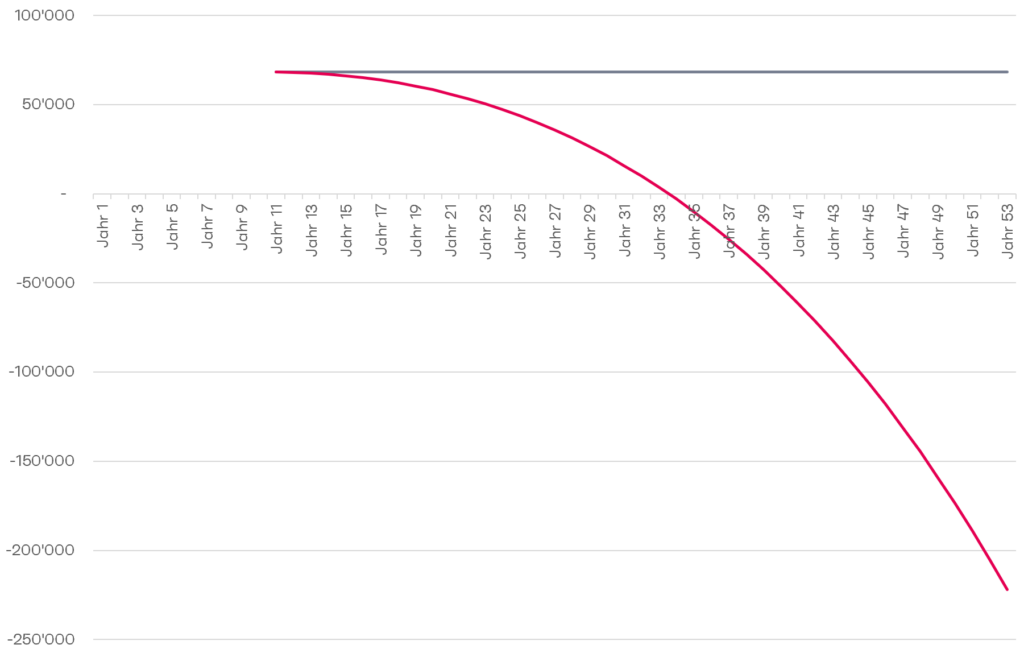

With the planned calculation of the purchase potential, the woman would be penalised because she invests the money profitably. Even without a subsequent 3a purchase, her purchase potential would fall to CHF 0 within 25 years – wiped out by the performance of the 3a fund (assuming 3 % p.a.).

The man who leaves the money in the 3a account would be rewarded for his risk aversion by being able to pay more into the pillar 3a than the woman and therefore also deduct more from his taxes.

Interest accrual at the BVG minimum interest rate too low

The largest possible 3a credit balance accrues interest at the BVG minimum interest rate:

There is no differentiation between securities and account solutions, which leads to unequal treatment:

- Account solutions benefit from the compounding of the purchase potential. The compounding is higher than the current interest rate.

- Securities solutions do not benefit because the compounding rate for securities solutions is too low.

Read more about pillar 3a.