What is a vested benefits account, and when do I need one? What are the rules for withdrawing from a vested benefits account – do I have to pay taxes? In this article, we answer all your questions about vested benefits accounts in detail.

Table of contents

What is a vested benefits account in Switzerland?

The most common reason for opening a vested benefits account is when you leave your job without immediately starting a new one. In this situation, you automatically exit your previous pension fund and become entitled to a vested benefits payout, which consists of your accumulated savings.

A vested benefits account is designed to hold the money you have accumulated in your pension fund. The balance remains there until you enroll in another pension fund. If you do decide to leave Switzerland, you have the option to receive an early payout from your pension fund.

In order to open a vested benefits account, you must meet the criteria for a vested benefits case. We will explain these criteria in more detail in the next section.

What is a vested benefits case?

When a vested benefits case arises, you gain the freedom to decide the fate of your pension fund assets. This is precisely why it is referred to as “vested benefits.” You can choose not only the provider but also how you want to manage your funds, whether that be through an account, a portfolio, or a policy. Let’s now examine the various vested benefits cases.

All vested benefits cases with the pension fund

- Career break: You are temporarily unemployed (e.g., traveling the world, unemployed, pursuing further education, or providing childcare).

- Moving abroad: You relocate to another country, opting not to withdraw the funds or working abroad for a period of time.

- Falling below the BVG entry threshold: You reduce your working hours and your salary no longer meets the BVG entry threshold.

- Self-employment: You become self-employed and choose not to withdraw your vested benefits.

- Divorce settlement: You’ve divorced and received part of your former partner’s pension fund savings. (If you are not affiliated with a pension fund, the money is transferred to a vested benefits account.)

Do I have to recontribute the vested benefits funds if I have a new job?

If you start a new job and join a pension fund, you typically need to recontribute your vested benefits, which applies up to the maximum regulatory limits.

How many vested benefits accounts can I have?

You are not legally restricted in the number of vested benefits accounts you can have; theoretically, you can maintain an unlimited number of them at the same time. However, when it comes to withdrawing funds from your pension, you are only permitted to split the amounts across a maximum of two accounts.

How can you open two vested benefits accounts at the same time?

Are you planning to leave your pension fund? If so, you can request that your previous pension institution transfer the vested benefits to two different vested benefits foundations. This process is known as splitting.

There are several advantages to splitting:

- You will have greater flexibility in investing your vested benefits funds. You can deposit a portion of the funds into a vested benefits account while investing the other portion in securities.

- When you invest in a new pension fund, you have the option to leave one of your existing pots untouched. This allows you to manage the assets in that pot personally. As a result, you’ll be less impacted by the widespread redistribution effects associated with the second pillar of pension funds.

- Having two vested benefits accounts allows you to withdraw your pension assets in different years, which can help you save on taxes.

At finpension, splitting is simple and convenient. You can learn more about splitting and its benefits in our article “How to split your pension fund.”

Which providers are available for vested benefits accounts?

As mentioned at the beginning of this article, there are non-bank providers, in addition to traditional banks, that offer account and investment solutions for your vested benefits assets. When it comes to investing your vested benefits, digital providers tend to be more attractive than banks. Many banks impose high recurring fees, often exceeding one percent. In Switzerland, the following types of providers offer solutions for managing your vested benefits:

- Banks: e.g., UBS, Raiffeisen, or Zürcher Kantonalbank

- Insurance companies: e.g., SwissLife, Baloise

- Digital providers: e.g., VIAC, frankly, or finpension

Vested benefits accounts at banks

Interest rates on vested benefits accounts are usually lower than those on 3a accounts. This is because funds in vested benefits accounts are often held for a shorter duration. As a result, banks have limited interest in these accounts, even though they frequently contain larger amounts than those in the third pillar.

It’s essential to compare the current interest rates and fees for vested benefit accounts. Some accounts may charge additional fees for management or closure, which should be included in your comparison. Below is a snapshot from our analysis:

| January 2026 | Account management per year | Fees WEF reference | Charges Balancing | |

|---|---|---|---|---|

| Hypo Vorarlberg (Schweiz) | 0.5% | – | 400.00 | 25.00 |

| Caisse d’Epargne d’Aubonne | 0.5% | 36.00 | n.a. | n.a. |

| Caisse d’Epargne de Cossonay | 0.4% | – | 400.00 | 25.00 |

Vested benefits policies from insurance companies

You can use your vested benefits capital to purchase an insurance policy that offers coverage in case of death or disability. However, this insurance protection comes at a cost. You will need to pay a premium that includes the expenses associated with the insurance.

We recommend keeping insurance separate from savings. These products often lack transparency, making them expensive. Generally, any insurance needs should be handled separately from your vested benefits.

Digital providers of vested benefits accounts

Digital providers of vested benefits accounts are distinguished by their much simpler account setup process compared to traditional banks. You can open an account online in just a few minutes. Some of the top digital providers of vested benefits accounts include VIAC, Frankly, and finpension.

At the finpension vested benefits, you can easily select between two options, depending on whether you want to keep the money in a traditional account or invest it in securities. This makes the registration process with finpension particularly straightforward.

Why should I invest my vested benefits in securities?

For individuals with a short investment horizon, a vested benefits account is the safest option. It is important to compare interest rates and fees across different providers and to confirm that the account can be easily opened online. The average interest rate on vested benefits accounts is currently low, at just 0.16%. Even with compound interest, it’s unlikely that you will see significant growth in your money.

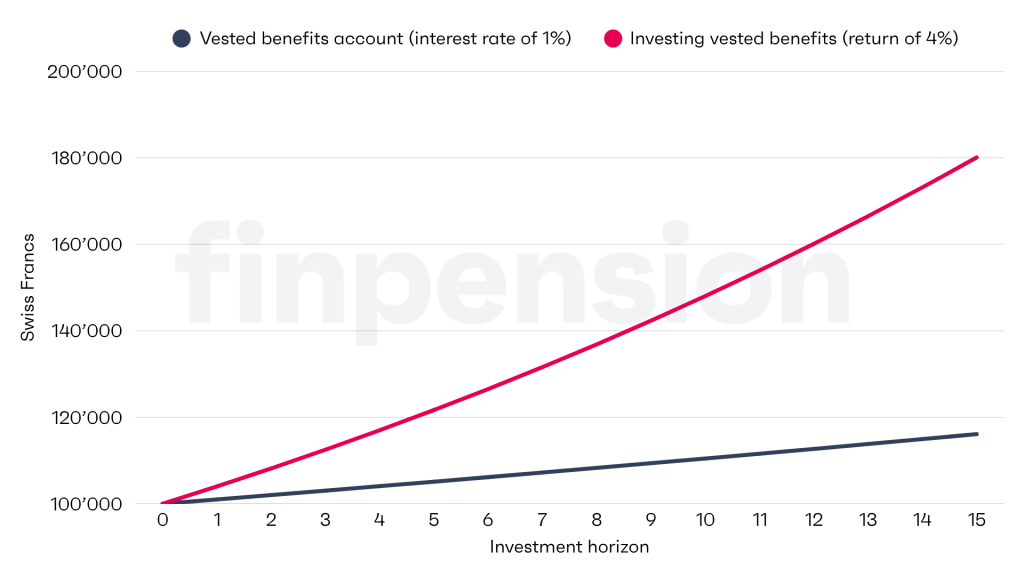

However, those with a longer investment horizon of several years can achieve higher returns by investing in securities. The illustration below illustrates how compound interest affects wealth over a 15-year period. By investing in a vested benefits custody account with an annual return of 4%, you could nearly double your wealth.

Account or portfolio: differences as a table

| Vested benefits account | Vested benefits custody account | |

| Investment form | Account with interest, cash | Investment in securities |

| Withdrawal of funds | Withdrawal as capital, no pension | Withdrawal as capital, no pension |

| Risk | Low | Depending on the chosen strategy, high risk Possible price fluctuations |

| Tax benefits | No wealth tax Interest is tax-free | No wealth tax Dividends and interest are tax-free |

| Bankruptcy of the supplier | Balance falls into the second bankruptcy class Deposit insurance of CHF 100,000 | Securities are considered special assets and are fully issued to you |

Reasons to invest your vested benefits with finpension

finpension is known for its cost-effective securities solutions for vested benefits. Here are some of our advantages:

- With finpension, you can split your pension fund termination benefits and manage both parts within the same app.

- With finpension, you can invest up to 100% in equities. In contrast, Frankly limits the equity component to 75%. VIAC distinguishes between mandatory and extra-mandatory investments: for mandatory retirement savings, you can invest a maximum of 80% in equities, while for extra-mandatory investments, the limit is 100%.

- finpension offers funds from three Swiss fund houses: former Credit Suisse, Swisscanto, and UBS. VIAC provides funds from UBS and Swisscanto, while Frankly exclusively offers funds from Swisscanto, as both Frankly and Swisscanto are part of Zürcher Kantonalbank.

- finpension now offers an investment solution for free assets, allowing the transfer of vested benefits into free assets upon retirement.

When can I withdraw from my vested benefits account?

Generally, you can only withdraw from your vested benefits account upon retirement. However, there are exceptions. You can access the funds earlier in the following cases:

- If you want to purchase owner-occupied property (real estate),

- If you become self-employed (must be recognized by the compensation office),

- Or if you emigrate.

As an alternative to withdrawing for real estate, you can opt for a pledge, especially if you want to keep the vested benefits funds invested in securities.

Are taxes due when withdrawing from a vested benefits account?

When you withdraw funds from a vested benefits account, you must pay the so-called capital withdrawal tax. You can find more information on how this tax is calculated and its rates in the linked article.

Tax advantages of vested benefits accounts

Funds in vested benefit accounts are not subject to wealth tax until withdrawn. Additionally, income generated from these assets, such as dividends and interest, is tax-free and does not need to be reported on tax returns.

Who inherits the vested benefits account in case of death?

Many believe that a vested benefits account is part of the deceased person’s estate. However, this is not the case. The vested benefits account is distributed separately from the estate.

Vested benefits accounts are primarily intended to benefit those who were financially dependent on the deceased account holder. For detailed information on how the funds are distributed, please refer to our article on vested benefits accounts in the event of death.The average interest rate on vested benefits accounts is currently low, at just 0.16%, according to our comparison of interest rates on these accounts. Even with compound interest, it’s unlikely that you will see significant growth in your money.