In most cases, people who earn more pay a higher percentage of tax than those with a lower income. We explain the taxable income and show examples of how high the progressive tax rate for the income tax can be in Switzerland in Zurich, Schwyz, and Bern.

Contents

Income tax in Switzerland: What you need to know

Tax rates vary depending on where you live, as taxes in Switzerland are levied not only by the federal government, but also by the cantons and municipalities. Income tax is generally progressive; only the cantons of Obwalden and Uri have a standardised tax rate that is independent of salary. The amount of income tax is always determined by the taxable income.

What is the taxable income in Switzerland?

The taxable income consists of your net salary and several deductions are possible. The income includes not only your net salary including bonuses and other received compensations, but also:

- Pension payments

- Compensation for loss of work or health

- Income from real estate

- Income from interest and dividends from private investments

Income tax in Zurich, Bern and Schwyz

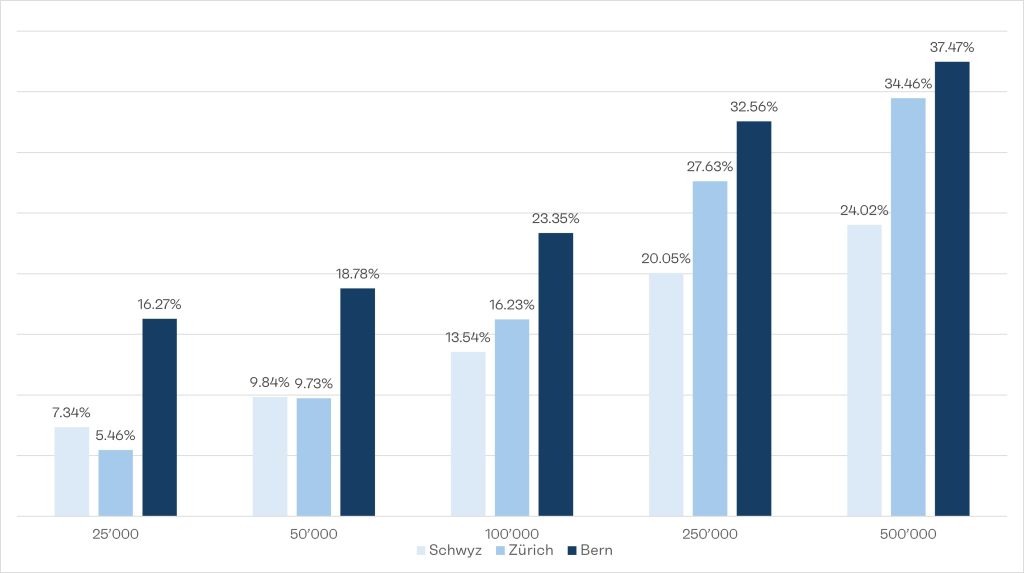

We now take a look at the tax progression in the cities of Zurich, Bern and Schwyz in comparison. The table shows the combined federal, cantonal and municipal taxes as a percentage of taxable income.

Here is the tax progression in Zurich, Bern and Schwyz as a table and in Swiss francs:

| Taxable income in CHF | Income tax in Schwyz | Income tax in Zurich | Income tax in Bern |

| 25’000 | 1’835 | 1’366 | 4’068 |

| 50’000 | 4’922 | 4’866 | 9’389 |

| 100’000 | 13’540 | 16’230 | 23’350 |

| 250’000 | 50’129 | 69’068 | 81’402 |

| 500’000 | 120’096 | 172’304 | 187’344 |

What does tax progression mean?

The term tax progression means that the tax increases with increasing income, not only in francs but also as a percentage.

An example: Mrs Urwyler lives in the city of Bern and has a taxable income of CHF 50,000 per year. Her income tax is CHF 9,389, i.e. 18.78% of her taxable salary. Mr Schneider, on the other hand, only has a taxable salary of CHF 25,000 and pays tax of CHF 4,068. Based on his income, Mr Schneider must pay 16.27%. Assumption: Both are single, non-denominational and have no children.

Source: Tax calculator of the Federal Tax Administration, tax year 2024

Mitigate your income tax through deductions

Tax progression can be mitigated by making deductions in your tax return. One option is to pay into pillar 3a, as you can deduct the payments in full from your taxable income. You can find out more about the tax savings of pillar 3a in the linked article.

The other tax deductions vary from canton to canton. Possible deductions are (non-exhaustive list):

- Health insurance premiums

- Deductions for married couples

- Children’s deductions

- Deductions for external childcare

- General professional expenses

- Travel costs to the place of work (public transport)

- Out-of-town catering costs (on working days if you cannot go home for lunch)

What applies when withdrawing pension assets?

If you draw from a pension fund and pillar 3a, a progressive tax usually applies. You can find out more in the article on capital withdrawal tax.

Read more: