For a few years now, new 3a offers have been launched on an ongoing basis. In this article, we take up the topic. Which of these providers currently offers the best pillar 3a in Switzerland – and for whom? Broadly speaking, there are four types of pension plans, each of which is best suited to a different 3a offer.

Table of contents

| Best pillar 3a for the frugal: Account |

| Best pillar 3a for yield optimisers: Securities |

| Best pillar 3a for the conscientious: Sustainable funds |

| Best pillar 3a for the undecided: Account or securities |

The best pillar 3a is the one that suits you

The main motivation for paying into pillar 3a in Switzerland is to save tax at the same time. Even if the tax savings vary depending on income and place of residence, the tax deduction is the main reason for paying into pillar 3a. Paying into a private pension today is therefore not only worthwhile in old age. You can benefit as early as your next tax bill. But which 3a offer is best for you?

When it comes to choosing the right or even the best provider for pillar 3a, things can quickly become complicated. Firstly, there is no such thing as the best provider. There is no one offer that is best for everyone. That’s why this article is not about finding the best provider. We want to crystallise here which are the best offers for different needs. Roughly speaking, four types of pension can be defined: Frugal, Yield Optimiser, Conscientious and Indecisive.

Best pillar 3a for the frugal:

3a retirement savings account

The classic solution is suitable for the frugal: the 3a account. The 3a account is the simplest option. With a 3a retirement savings account, you are on the safe side, but you won’t make any great leaps in returns. Although there has been hardly any interest on a 3a account for some time now, you can already save a lot with the tax deduction. The 3a account is something for frugal people who are satisfied with what they put aside and do not strive for more.

Crédit Agricole next bank (Suisse) and Cornèr Banca with the best interest rate

Crédit Agricole next bank (Suisse) and Cornèr Banca are now at the top of the 3a interest list. They pay 1.4 per cent on the 3a account. All other providers pay 1.25 per cent interest or less on the 3a account.

| Provider / Bank | Interest p.a. |

| Crédit Agricole next bank (Suisse) | 1.4 % |

| Cornèr Banca | 1.4 % |

| further providers … | 1.25 % or lower |

Pillar 3a and bankruptcy

Anyone making recommendations for pillar 3a accounts should honestly also address and think through the possibility of bank bankruptcy. Although the last bankruptcy of a well-known Swiss bank was a very long time ago (1991, Spar- und Leihkasse Thun), the possibility of bankruptcy in the future cannot be completely ruled out.

Hence the question: Is a 3a account insured in the event of the bank’s bankruptcy?

The answer is no. 3a assets are not covered by deposit protection. are not part of the secured deposits are paid out immediately in the event of bankruptcy and outside the ordinary bankruptcy proceedings. But there is another privilege for 3a deposits: according to Article 37a paragraph 5 of the Banking Act, 3a account balances up to an amount of CHF 100,000 per beneficiary fall into the second bankruptcy class.

A bankruptcy plan is divided into three bankruptcy classes:

- Bankruptcy class: salaries and pension fund contributions

- Bankruptcy class: social security contributions

- Bankruptcy class: All other receivables

Without this privilege in accordance with Art. 37a of the Banking Act, claims from foundations for tied pension provision (pillar 3a) would fall into the third bankruptcy class. Thanks to the privilege, they fall into the second bankruptcy class up to a balance of CHF 100,000 per beneficiary.

But enough of the legal explanations. Let’s now turn our attention to the riskier solutions. If you want to get more out of your assets, you’ll find the right 3a solution there.

Best pillar 3a for yield optimisers:

3a funds / 3a securities

If you expect more from your 3rd pillar, you may have heard that you can invest your pillar 3a in securities. However, anyone who invests their pillar 3a in equities should do so with conviction because they know about the advantages of 3a equity funds:

- Very long investment horizon (in contrast to free assets)

- Tax-free dividends

- Compound interest effect

Important restriction: In pillar 3a, it is not possible to invest in a single share. Return-optimisers cannot open a 3a custody account and use it to trade, as they are used to doing with their free assets.

Pension assets must be invested in a diversified manner. This is why only 3a funds or 3a investment strategies are suitable.

Let’s start with the analysis to evaluate the best provider. Which are the best 3a funds or the best 3a fund providers?

The best 3a funds and securities solutions

As already explained, 3a equity funds have the advantage of yielding tax-free dividends. It is true that withholding tax is also levied on these funds by the federal government. However, these withholding taxes can be reclaimed by the pension fund from the Federal Tax Administration.

The same principle also applies internationally. In many double taxation agreements with other countries, pension assets are treated favourably. This means that taxes that are deducted locally on dividends and interest (so-called withholding taxes) can be reclaimed.

Criterion 1: Withholding tax

Because ETFs can reclaim less withholding tax than pure pension funds, ETFs are only the second choice for yield optimisers when it comes to investing pillar 3a in securities. Not interesting for the yield optimization due to the ETF shares is therefore the offer of Selma. There, the 3a investments are implemented with ETFs, in cooperation with the VZ Vermögenszentrum.

Selma therefore has no chance in the award for the best offer and is eliminated from the selection. Other providers remain in the running and are assessed according to the second criterion.

Criterion 2: annual costs

The next selection criterion is the annual costs. All providers with total annual costs of more than 0.50 % are not attractive for yield optimizers and are excluded from the comparison:

| Provider | Management fee per year | Fund costs (TER) | Total costs |

| Descartes | 0.20 – 0.40 % | 0.24 – 0.60 % | 0.64 – 0.80 % |

| Gioia3a | 0.10 % | 0.62 – 0.92 % | 0.72 – 1.02 % |

| Fluks3a (LUKB) | 0.60 % | 0.00 % | 0.60 % |

| Denk3a (SGKB) | 0.00 % | 0.60 – 0.69 % | 0.60 – 0.69 % |

| Tellco | 0.00 % | 0.59 – 0.71 % | 0.61 – 0.74 % |

| Volt 3a | 0.48 % | 0.17 – 0.20 % | 0.65 – 0.68 % |

We assume that most of these providers use funds that are not optimised for withholding tax. It is therefore not only the fees, but also the quality of these pension funds that do not convince the yield optimisers anyway.

Four suitable offers for yield optimisation (sorted alphabetically):

| Provider | Funds utilised | Foundation |

| finpension | Index funds from Credit Suisse, Swisscanto and UBS | finpension 3a pension foundation |

| frankly | Swisscanto’s own funds | Zürcher Kantonalbank Pension Foundation Savings 3 |

| VIAC | Mainly Credit Suisse Index Funds (CSIF), partly ETF | Terzo Pension Foundation of WIR Bank |

| Yapeal | Vontobel Pension Invest Fund | Vontobel 3a Pension Foundation |

Yapeal-3a is a good offer. Investing your own pillar 3a in securities with Yapeal only costs between 0.42 and 0.47 % per year. One disadvantage is that you can only take out the offer if you open a private account (bank account with Visa debit card). The Yapeal account is, so to speak, the basis for all other Yapeal offers. Another disadvantage is that only two funds are available with an equity component of 35 to a maximum of 50 %. This is not enough for yield optimizers, so we move on to VIAC.

VIAC is a very good provider that brought a lot of dynamism to the pension market with the launch of its 3a app in 2017. VIAC offers two sets of investment strategies ranging from 0% to 100% equities, with the option of using bonds or cash for each set. The portion that is not invested in equities or precious metals is therefore either invested in bonds or held as cash at WIR Bank. No fees are charged on the cash portion and those who feel they are in good hands with WIR Bank also receive a good interest rate. Our yield optimisers also feel comfortable with VIAC. The only disadvantage is the margin on foreign currency transactions, which WIR Bank charges as VIAC’s transaction processor. What is the situation with Frankly?

Frankly is also a very good provider, on a similar level to VIAC. Like VIAC, Frankly does not currently charge any fees on the cash portion, although this was not the case in the past. The fees are low and the performance of the ZKB funds is decent. What is missing, in contrast to VIAC and finpension, is the possibility to individualise the investment strategies. One more note: Frankly’s pricing model has a special feature. Anyone who makes advance withdrawals for residential property does not have to pay any additional compensation for the foundation’s auditing costs – these costs are borne by the Frankly community with the all-in fee.

Now to finpension: The finpension offer is a little more favourable than that of Frankly and VIAC. Our offer is optimally tailored to 3a savers who wish to invest a high proportion of their pillar 3a in equities. With the finpension 3a app, you can invest up to 99 % (VIAC 99 %, Frankly 95 %) in equities. In addition, we do not subscribe to funds in foreign currencies at all, which means that there are no transaction fees for foreign currency exchange (if necessary, the foreign currency exchange within the fund takes place at the mid-market rate and without a premium). For yield optimisers, finpension is therefore the best offer on the market.

Why we are not convinced by Yuh’s pillar 3a

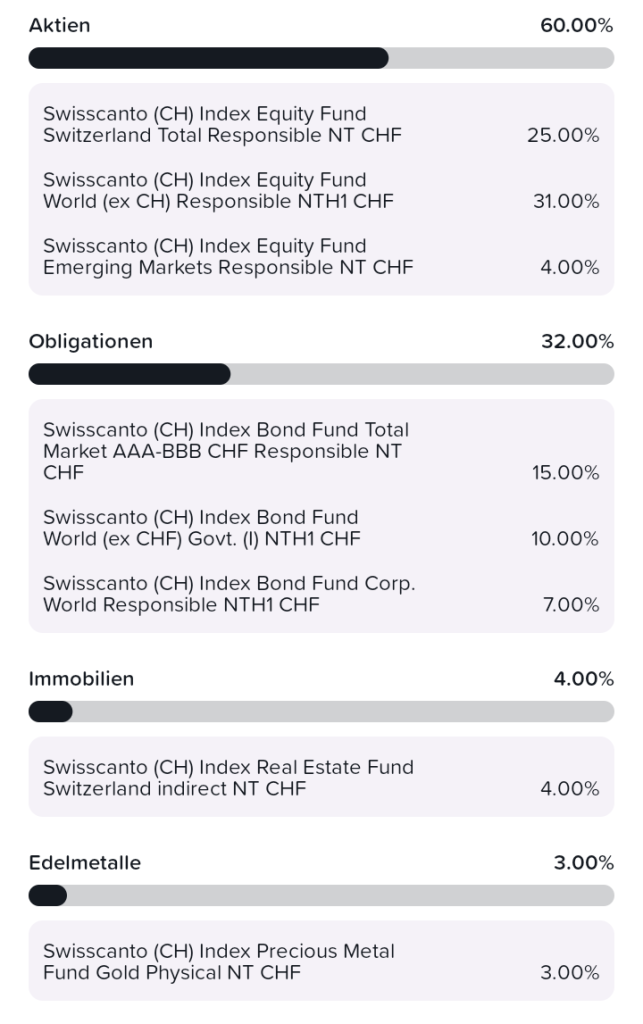

Yuh launched her pillar 3a in mid-2023, which costs a flat rate of 0.50 % per year. That’s okay. Yuh relies on funds from Swisscanto. But: We realised that Yuh is not using the pension funds as expected, but the non-pension funds (e.g. Swisscanto (CH) Index Equity Fund World (ex CH) Responsible NTH1 CHF). At Swisscanto, the pension funds contain the abbreviation “IPF” in their name, which means “Institutional Pension Fund” (cf. e.g. Swisscanto (CH) IPF I Index Equity Fund World ex CH NTH CHF). Why Yuh does not use pension funds is incomprehensible. However, the consequence is that Yuh’s 3a offer is not to be recommended.

Why we are not convinced by True Wealth’s pillar 3a

Finally, there is another offer that should not go unmentioned, namely that of True Wealth. True Wealth offers its pillar 3a in cooperation with Basellandschaftliche Kantonalbank. True Wealth does not charge any fees on 3a assets. The only costs incurred by True Wealth for pillar 3a are within the funds offered (0.13 – 0.21 %).

Nevertheless, we are not convinced by True Wealth’s 3a offer. In our view, the offer is a case of overengineering. For example, True Wealth automatically creates up to five 3a accounts in the first five years. A new account is also opened for each 3a account transferred. No more deposits can be made into the transferred accounts. Even if several pillar 3a accounts can be useful, we consider this automatic system to be a considerable restriction on flexibility.

What’s more, True Wealth takes a scientific approach to asset allocation, as we wrote about in our article on digital asset managers. Performance figures are needed to assess the success of this approach. You won’t find any such figures on the True Wealth website.

Performance comparison of the best pillar 3a providers

Of course, a serious comparison also includes an examination of performance. During our research, however, we found that many of the new providers offer little transparency. Not all providers show on their website how the 3a funds have performed or would have performed over the past one, three and five years.

In our performance comparison, we only consider the four suitable offers for yield optimizers. As we did not find any information on Yapeal’s performance, they are also excluded from the comparison. A few comments on this comparison (as at the end of December 2023):

- The table is sorted by share percentage.

- The performance figures reported by VIAC and finpension are already stated net of costs in the respective factsheets. As both VIAC and finpension offer different fund houses, we have calculated the average performance in each case.

- VIAC strategies offer the option of holding liquidity in the form of cash or bonds. Liquidity refers to the portion that is not invested in equities or property. As the finpension and Frankly strategies are also based on bonds, we have also based VIAC’s investment preference on bonds.

- For the funds used by Frankly, the management fee had to be deducted first (2020: 0.48%, 2021: 0.47%, 2022: 0.46%; 2023: 0.45%).

- The five-year performance of the Frankly funds is still largely missing, as the funds were only launched in 2019 or 2020.

- WIR Bank’s fees on foreign currency exchange are not yet included in the performance of the VIAC strategies.

| a / p | Aktienanteil | 1 J | 3 J | 5 J | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| finpension Global 100 | passiv | 100% | 9.23% | 2.91% | 7.93% | 25.58% | 7.00% | 20.66% | -17.66% | 9.23% |

| finpension Schweiz 100 | passiv | 100% | 7.70% | 2.67% | 7.90% | 27.67% | 5.82% | 21.67% | -17.78% | 7.70% |

| finpension Nachhaltig 100 | passiv | 100% | 9.22% | 2.96% | 7.89% | 25.65% | 6.62% | 21.19% | -18.02% | 9.22% |

| VIAC Global 100 | passiv | 100% | 8.50% | 3.05% | 7.65% | 25.25% | 5.35% | 20.75% | -16.50% | 8.50% |

| VIAC Schweiz 100 | passiv | 100% | 7.65% | 2.65% | 7.70% | 27.20% | 5.30% | 21.95% | -17.60% | 7.65% |

| VIAC Global Nachhaltig 100 | passiv | 100% | 9.15% | 3.40% | 7.90% | 25.35% | 5.45% | 22.30% | -17.10% | 9.15% |

| Frankly Extreme 95 Sustainable | aktiv | 95% | ||||||||

| Frankly Extreme 95 Responsible | aktiv | 95% | 10.68% | -16.77% | 10.68% | |||||

| Frankly Extreme 95 Index | passiv | 95% | 10.68% | 2.64% | 19.14% | -17.84% | 10.45% | |||

| finpension Global 80 | passiv | 80% | 8.22% | 1.86% | 6.59% | 22.97% | 5.88% | 18.15% | -17.67% | 8.22% |

| finpension Schweiz 80 | passiv | 80% | 7.02% | 1.62% | 6.60% | 24.48% | 5.40% | 18.36% | -17.52% | 7.02% |

| finpension Nachhaltig 80 | passiv | 80% | 8.14% | 1.87% | 6.54% | 23.07% | 5.53% | 18.54% | -17.95% | 8.14% |

| VIAC Global 80 | passiv | 80% | 7.65% | 2.65% | 6.95% | 23.35% | 4.75% | 16.60% | -15.50% | 7.65% |

| VIAC Schweiz 80 | passiv | 80% | 6.75% | 2.20% | 7.05% | 25.10% | 5.15% | 19.00% | -15.90% | 6.75% |

| VIAC Global Nachhaltig 80 | passiv | 80% | 8.40% | 2.90% | 6.85% | 22.40% | 4.50% | 20.00% | -16.25% | 8.40% |

| Frankly Strong 75 Sustainable | aktiv | 75% | ||||||||

| Frankly Strong 75 Responsible | aktiv | 75% | 8.87% | 3.14% | 6.20% | 17.79% | -14.45% | 8.87% | ||

| Frankly Strong 75 Index | passiv | 75% | 7.51% | 1.75% | 27.49% | 16.07% | -15.60% | 7.51% | ||

| finpension Global 60 | passiv | 60% | 7.20% | 0.26% | 4.82% | 18.68% | 5.79% | 13.24% | -17.20% | 7.20% |

| finpension Schweiz 60 | passiv | 60% | 6.60% | 0.22% | 4.82% | 19.71% | 5.04% | 13.27% | -16.90% | 6.60% |

| finpension Nachhaltig 60 | passiv | 60% | 7.11% | 0.25% | 4.78% | 18.93% | 5.41% | 13.52% | -17.43% | 7.11% |

| VIAC Global 60 | passiv | 60% | 7.00% | 2.45% | 5.70% | 17.65% | 4.20% | 14.50% | -12.25% | 7.00% |

| VIAC Schweiz 60 | passiv | 60% | 6.05% | 2.25% | 5.85% | 19.30% | 4.00% | 14.45% | -11.90% | 6.05% |

| VIAC Global Nachhaltig 60 | passiv | 60% | 7.50% | 2.55% | 5.60% | 17.10% | 3.80% | 15.25% | -12.80% | 7.50% |

| Frankly Moderate 45 Sustainable | aktiv | 45% | ||||||||

| Frankly Moderate 45 Responsible | aktiv | 45% | 6.05% | 1.19% | 3.91% | 10.14% | -11.29% | 6.05% | ||

| Frankly Moderate 45 Index | passiv | 45% | 5.20% | -0.28% | 17.52% | 9.57% | -13.98% | 5.20% | ||

| finpension Global 40 | passiv | 40% | 6.30% | -1.25% | 3.04% | 14.82% | 5.09% | 8.49% | -16.64% | 6.30% |

| finpension Schweiz 40 | passiv | 40% | 6.00% | -1.30% | 3.00% | 15.29% | 4.56% | 8.24% | -16.34% | 6.00% |

| finpension Nachhaltig 40 | passiv | 40% | 6.14% | -1.30% | 3.05% | 15.11% | 4.99% | 8.59% | -16.76% | 6.14% |

| VIAC Global 40 | passiv | 40% | 6.25% | 2.15% | 4.30% | 12.30% | 2.95% | 10.10% | -8.85% | 6.25% |

| VIAC Schweiz 40 | passiv | 40% | 5.70% | 2.00% | 4.40% | 13.40% | 2.90% | 9.85% | -8.55% | 5.70% |

| VIAC Global Nachhaltig 40 | passiv | 40% | 6.55% | 2.25% | 4.20% | 11.95% | 2.65% | 10.65% | -9.30% | 6.55% |

| Frankly Gentle 25 Sustainable | aktiv | 25% | ||||||||

| Frankly Genlte 25 Responsible | aktiv | 25% | 5.58% | -0.13% | 2.99% | 5.23% | -10.35% | 5.58% | ||

| Frankly Gentle 25 Index | passiv | 25% | 4.80% | -1.72% | 4.00% | 4.17% | -13.04% | 4.80% | ||

| finpension Global 20 | passiv | 20% | 5.28% | -2.82% | 1.21% | 10.96% | 4.31% | 3.96% | -16.17% | 5.28% |

| finpension Schweiz 20 | passiv | 20% | 5.26% | -2.77% | 1.13% | 10.86% | 3.80% | 3.53% | -15.71% | 5.26% |

| finpension Nachhaltig 20 | passiv | 20% | 5.07% | -2.93% | 1.18% | 11.30% | 4.16% | 3.92% | -16.28% | 5.07% |

| VIAC Global 20 | passiv | 20% | 5.50% | 1.90% | 2.90% | 7.30% | 1.60% | 6.00% | -5.35% | 5.50% |

| VIAC Schweiz 20 | passiv | 20% | 5.20% | 1.70% | 2.85% | 7.60% | 1.70% | 5.60% | -5.25% | 5.20% |

| VIAC Global Nachhaltig 20 | passiv | 20% | 5.65% | 1.90% | 2.80% | 7.00% | 1.45% | 6.25% | -5.65% | 5.65% |

| Frankly Light 15 Responsible | aktiv | 15% | 5.69% | -1.21% | 2.10% | 1.55% | -10.17% | 5.69% | ||

| VIAC Konto Plus Global | passiv | 5% | 1.30% | 0.60% | 0.80% | 1.65% | 0.40% | 1.30% | -0.80% | 1.30% |

| VIAC Konto Plus Schweiz | passiv | 5% | 1.10% | 0.60% | 0.80% | 1.60% | 0.30% | 1.45% | -0.65% | 1.10% |

| VIAC Konto Plus Nachhaltig | passiv | 5% | 1.30% | 0.60% | 0.80% | 1.70% | 0.45% | 1.50% | -0.80% | 1.30% |

| finpension Global 0 | passiv | 0% | 2.93% | -1.14% | -0.79% | -0.07% | -0.45% | -0.89% | -5.24% | 2.93% |

| finpension Schweiz 0 | passiv | 0% | 2.93% | -1.14% | -0.79% | -0.07% | -0.45% | -0.89% | -5.24% | 2.93% |

| finpension Nachhaltig 0 | passiv | 0% | 2.84% | -1.24% | -0.92% | -0.24% | -0.60% | -1.00% | -5.36% | 2.84% |

Best pillar 3a for the conscientious: Sustainable 3a funds

Those for whom sustainability is also important in 3a pension provision select according to different criteria than those who optimise returns. Accordingly, there are also other offers: Freya, for example, has placed the topic of sustainability very much at the centre of its communication. Pillar 3a should grow “decently”, as can be read on the Freya website. Freya has already withdrawn from the market. Likewise Pando from Swiss Life. Conscientious investors can consider the following offers that explicitly focus on sustainability:

- elleXX in collaboration with Vontobel

- Inyova in collaboration with Liberty

- Liberty Green (from Liberty itself)

- Others: VIAC, Frankly, finpension

Inyova is consistently committed to sustainability. The provider engages in impact investing and actively influences the decisions of the companies in which it invests. However, it is questionable to what extent Inyova has sufficient market power to really make a difference. The pension funds of the two major providers in Switzerland (UBS and Swisscanto) together manage several hundred billion francs in pension fund assets. Inyova’s 173 million have a much lower leverage effect. But if an economic system is to focus on more sustainable values, you have to start somewhere. And that’s what Inyova is trying to do.

Important to know: The return optimiser’s favourites also offer sustainable strategies – finpension even at the same attractively low fees. Conscientious investors therefore ask themselves whether the higher fees charged by Inyova and Co. are justified. This is not an easy decision for the conscientious, as the subject of sustainability is not an exact science and it is difficult to measure the effective benefit of sustainability funds for the environment.

Best pillar 3a for the undecided:

3a account / 3a securities

3a account or invest in securities? There is also a solution for the undecided. By undecided, we mean anyone who doesn’t really know what they want. Leave the 3a money in an account or invest it in securities? It is often a little too expensive for the undecided at the moment and they prefer to wait until share prices have corrected somewhat. Then the undecided might be prepared to invest their pillar 3a.

For the undecided, there are two clear favorites, namely VIAC and Frankly. In contrast to finpension, VIAC and Frankly do not charge a fee on the cash portion. One disadvantage of VIAC, however, is the fees on the foreign currency exchange, which is why frequent switching from cash to securities and back again is not really worthwhile with VIAC either.

Worst pillar 3a for almost everyone:

3a insurance / policy

For anyone who is independent, i.e. has no family, insurance is the least attractive form of pillar 3a. And even if you have a family or other commitments, a combined insurance policy that combines 3a savings with risk cover is not ideal. The reason? It is simply too expensive and the costs are not transparent.

Read more about the 3rd pillar as an insurance solution under: Pillar 3a with the bank or the insurance company?

What type of pension plan are you?

Which pension type do you recognise yourself as? If you are satisfied with a solid solution without ups and downs, you are one of the frugal types. If you want to get the most out of it, have patience and want to benefit from favourable price trends, you can optimise your returns with these offers. Anyone who is particularly concerned about sustainability will also find suitable offers as a conscientious investor. And there are other solutions for those who are undecided.

The most important thing: make a decision about your pension provision soon. Because the longer the investment horizon, the greater the potential of private pension provision.

Read more about pillar 3a.