Withdrawal plan: The clever solution for your retirement

With the withdrawal plan from finpension, you can have a pension paid out to yourself. We show you how it works and the advantages of the finpension investment solution.

How do you set up a withdrawal plan with finpension?

Step 1: Select investment strategy

The basis for a good withdrawal plan is the right investment strategy. finpension offers you investment strategies that have good risk diversification and are precisely tailored to your needs. Whether classic, sustainable or self-determined. You decide and we accompany you.

Simply register now via the web app or download the finpension app to your smartphone. Then start the registration process by selecting the “Invest assets” product.

Step 2: Transfer money

Transfer all or part of your assets to the portfolio you have opened. As part of automatic rebalancing, the assets are automatically invested in your chosen investment strategy.

Step 3: Enter regular payout (withdrawal plan)

Now enter the withdrawal plan. To do this, proceed as follows:

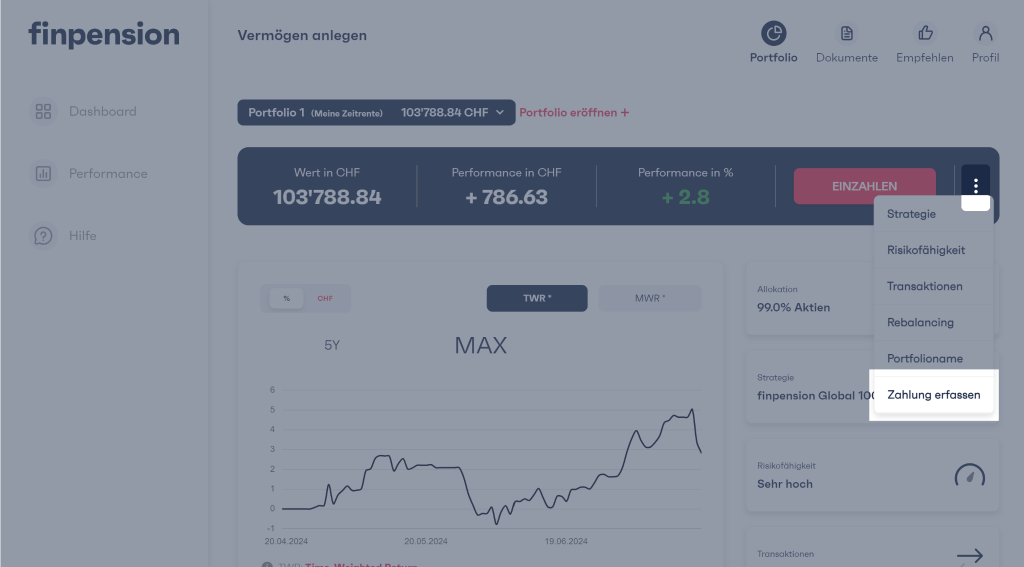

- Log in to the app.

- Click on the product “Invest assets”.

- You are now in the 1st portfolio. If you wish to make regular withdrawals from another portfolio, switch to the corresponding portfolio.

- Now click on the context menu. There you will find the “Enter payment” function. Please note that you will only see this function if the portfolio value is greater than zero.

- In the next step, select “Regular payout”.

You have the following setting options for the withdrawal plan:

- Amount in CHF

- Frequency (monthly, quarterly, annually)

- First version

- Last execution (or until cancelled)

Payment is made between the 20th and the last day of the month.

How do you determine the amount?

The amount you set for regular withdrawals depends heavily on your personal circumstances. A rather conservative calculation method is as follows:

- What is your remaining life expectancy? You can calculate this by subtracting your current age from the average life expectancy in Switzerland. As a man aged 65, this would be around 17 years.

- How high are your assets? Let’s assume one million francs.

- We also assume that you would like to receive a monthly payment.

CHF 1,000,000 / 17 years / 12 months = CHF 4,902

This calculation is rather conservative because it does not take into account the chance of a return. Assuming you calculate a return of three per cent, the monthly amount available will already increase significantly:

CHF 1,000,000 / 17 years / 12 months * 3 % yield = CHF 6,244

Source of the calculation: Cash flow

The result of this calculation is also known as a time annuity. A time annuity differs from a pension fund annuity in that it can only be paid out for as long as capital is available. As soon as the capital is fully utilised, the pension expires. Pension fund pensions, on the other hand, are paid out for life. The disadvantage is that, unlike the withdrawal plan, the pension fund pension must be taxed as income. More on this in the chapter “Pension or lump sum”.

Why is a withdrawal plan interesting?

Why a withdrawal plan?

A withdrawal plan is interesting if you have a lot of assets but not (or no longer) enough income to cover your living expenses. This is often the case in retirement and if you have decided against a pension from the pension fund.

It then makes sense to invest the assets and withdraw a portion of them regularly. Provided that the investment yields an appropriate return, for which there are good prospects from five to ten years, the capital depletion is less rapid than on a traditional bank account.

(picture follows)

Statistics show that average assets do not decrease at retirement age, but actually tend to increase. A withdrawal plan can also be an investment in the future of your descendants.

Advantages of a savings plan with finpension

The withdrawal plan from finpension is characterised by the following advantages:

- Very favourable management fee of just 0.39 %

- Very low fund costs of 0.08 to 0.10 %

- No transaction fees (only the usual stock exchange and stamp duties)

- Personal investment strategy can be changed at any time

- Simple opening of one or more portfolios

- Automatic payout as part of a withdrawal plan

You also have full flexibility with the finpension investment solution. You can adjust the withdrawal plan at any time, transfer more money to the portfolio or make larger one-off payouts.

Good to know: The assets remain untied, even with a savings plan. You can continue to dispose of them freely.

Disadvantages of a savings plan with finpension

In contrast to an account solution, investments fluctuate in value. Read more about investment risks in the Bankers Association’s brochure on risks in trading financial instruments.

Pension fund: transfer to private assets?

Pension funds are used by pension funds, but also in pillar 3a or by vested benefits foundations.

Are you with a provider that allows you to transfer your funds to your private assets on retirement? If so, we regret to disappoint you. It is not a sign of quality if pension funds can be transferred to private assets. This is because they are not genuine pension funds. You should therefore consider whether you are with the right provider.

Many people are afraid of the transaction costs if funds in the pension scheme have to be liquidated. With finpension, you don’t have to worry. As finpension itself does not charge any transaction fees or currency exchange fees and uses index funds that are not traded on the stock exchange (no stock exchange and stamp duties), transaction costs are limited to spread costs, which average less than 0.10 %.

Pension fund assets: Pension or capital?

When you retire, you have to decide whether you want to draw a pension or a lump sum. A combination of the two options is also possible.

Advantage of the pension from the PF

The advantage of a pension is that it is paid out until the end of your life. If you live longer than average, a pension pays off. A pension is generally also worthwhile for people with lower incomes because the statutory conversion rate has hardly been adjusted downwards since the introduction of occupational pension provision in the 1980s, despite the increase in life expectancy.

The pension conversion rate indicates how high the annual pension will be in relation to your pension fund assets. The conversion rate is currently 6.8 % (as at 2024). With CHF 100,000 in assets, you will therefore receive an annual pension of CHF 6,800. However, this only applies to the mandatory pension. As soon as you earn more than 88'200 francs a year, significantly lower pension conversion rates are common.

Disadvantage of a pension from the pension fund

The biggest disadvantage of a pension is that it (the pension) must be taxed as income. The alternative, the lump-sum withdrawal, does not have to be taxed as income. It is taxed separately from income at a reduced rate when it is withdrawn.

Depending on which canton you live in and how much income you will still have at retirement age, drawing a pension can lead to an additional tax burden. Read more about this in another article:

Capital withdrawal particularly interesting for high earners

For people with a high income and a “large” pension fund, it is often not worthwhile to have a lifelong pension paid out. Many of these people prefer to take a lump sum if the following conditions are met:

- The pension conversion rate of the pension fund is significantly lower than in the BVG mandatory scheme, which is currently 6.8 %.

- The capital withdrawal tax is lower than the income tax on the pension: The second factor depends on which canton you live in and how much income you still have after retirement.