This article shows why it is worth investing the 3rd pillar in securities and what to consider when selecting an investment solution.

Long investment horizon opens up opportunities for returns

A long investment horizon is the key when you want to invest money. The reason is relatively simple. If you only have a short time for an investment and you need the money again soon, it quickly happens that you have to sell the investments at a bad time and realise a loss.

However, if you have a long investment horizon, which is often the case in the 3rd pillar, a loss is less likely. During a crisis, on the one hand, you have time to wait for prices to recover. On the other hand, annual returns such as dividends and interest help to iron out dents more quickly.

Returns help to pass through valleys more quickly

When you invest broadly in stocks or bonds, you are credited with interests and dividends. If these interests and dividends are accumulated, they help to iron out possible dents in the market development quicker.

An example:

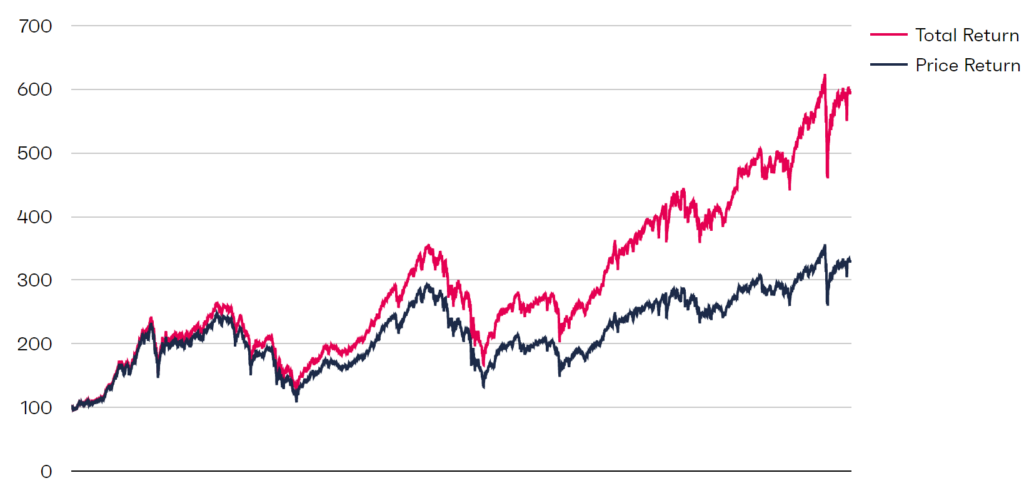

In the following graph you can see two curves. Both show the development of share prices since 1996 of companies listed on the Swiss stock exchange (Swiss Performance Index SPI):

- Red line: Total return (price development incl. dividends)

- Blue line: Price return (price development without dividends)

Swiss Performance Index from 3.1.1996 to 14.12.2020 (Start: 100):

The peak before the financial crisis was reached on June 1, 2007. This peak was reached again by the index with dividends (total return) for the first time on May 15, 2013. The price return (without dividends) took considerably longer. It did not reach its peak again until four years later.

| Peak before the financial crisis | Back on the peak | Recovery time | |

| Total Return | June 1, 2007 | May 15, 2013 | About 6 year |

| Price Return | June 1, 2007 | October 2, 2017 | About 10 year |

Note: The best-known Swiss stock index, the SMI, is a price index and does not take dividend payments into account. Caution is therefore advised when interpreting it. Otherwise, you can quickly get the impression that you have earned nothing at all over a long period of time.

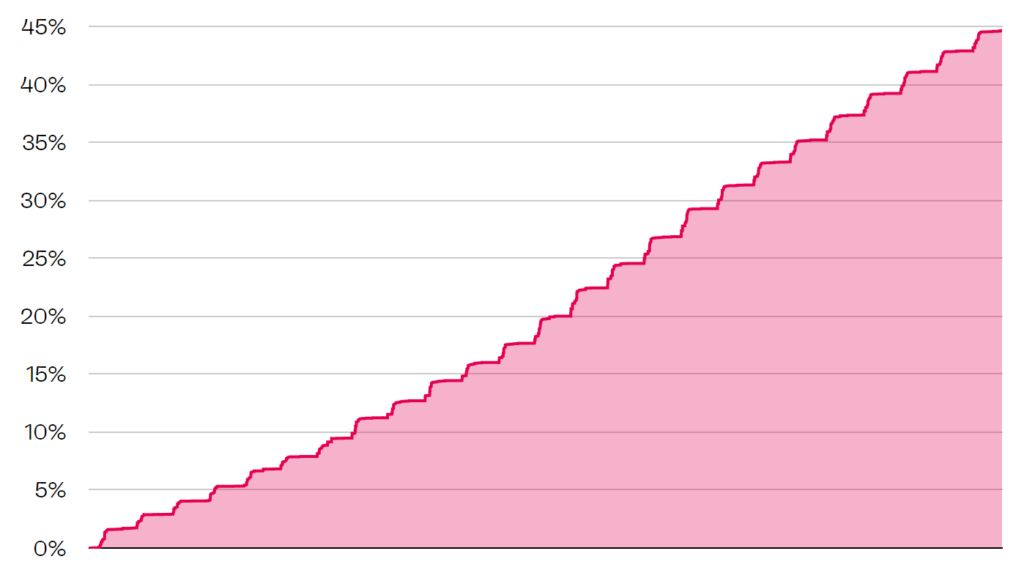

Earnings form a constantly growing buffer that can smooth possible price losses

Another advantage of a long investment horizon is the constantly growing buffer (reinvested dividend payouts).

The cushion that an investment in the SPI has been able to build up over the past 25 years on the basis of returns alone is very large. It will add up to around 45% by the end of 2020.

In other words: After 25 years, one could accept a price loss of up to 45% without falling into the red or scratching possible price gains.

Buffer = SPI Total Return – SPI Price Return in relation to SPI Total Return

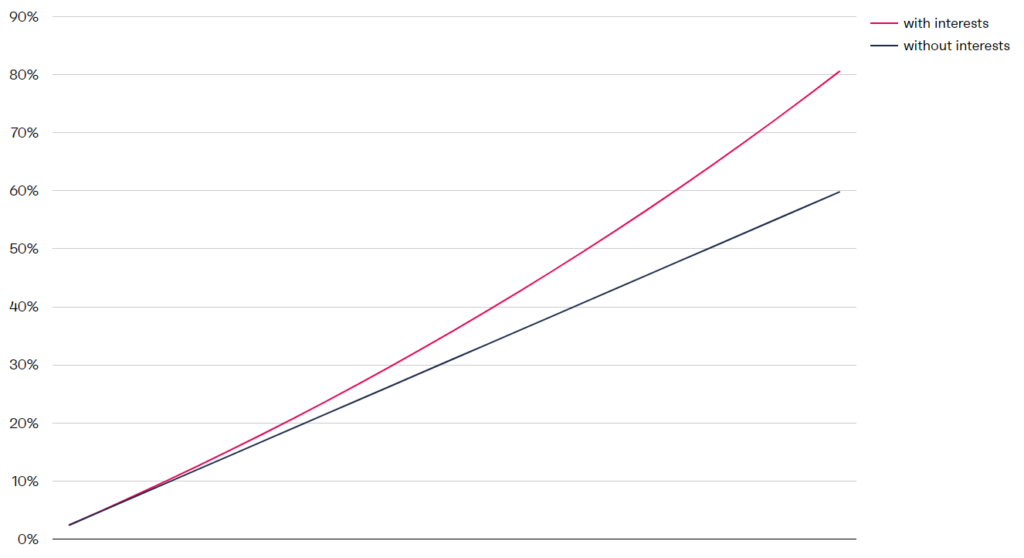

Finally, the compound interest effect increases the return additionally

At the end of this chapter, we would like to show the difference between reinvesting the income and thus benefiting from the compound interest effect and not reinvesting the income.

The effect is considerable. With an average annual return of 2.39%, the additional return over the 25 years is 20% thanks to the compound interest effect.

Comparison of return with or without compound interest at an annualised return of 2.39 % over 25 years

An income-oriented strategy in the 3rd pillar is also better from a tax perspective

Income that accrues on pension assets is tax-free. For this reason, it is interesting to pursue an income-oriented strategy with the 3rd pillar using shares, real estate and bonds.

Gold or crypto currencies such as Bitcoin are less optimal for pension purposes. Since pension assets must be taxed when they are withdrawn, you will also pay a capital gains tax later on the portion that you have earned through price gains.

This is in complete contrast to free assets. There you do not have to pay tax on capital gains. So you should better keep gold or crypto currencies in free assets.

| Interesting, because capital gains in free assets are tax-free.Primary goal | Income (dividends and interests) | Price or capital gains |

| pension assets | Interesting, because income in the pension plan is tax-free. | |

| free assets | Interesting, because capital gains in free assets are tax-free. |

Reclaiming withholding taxes is a must

If you pursue an income-oriented strategy with the 3rd pillar, you will inevitably generate dividends and interest earnings. Often, this income is reinvested in the fund, which is also called thesauration.

Now, as a rule, a tax is deducted from such income. In Switzerland, this is called withholding tax (“Verrechnungssteuer” in German). The withholding tax can be reclaimed if the income is stated in the tax return.

Internationally, we speak of withholding taxes (“Quellensteuer” in German), which are deducted on dividends and interests. If you invest in funds that do not reclaim foreign withholding taxes, you lose up to half a percent in performance per year. Therefore, it is important to use funds that can reclaim foreign withholding taxes.

Transferability of investments to private assets is not a seal of approval

It is often sold as an important advantage that a fund can be transferred to free assets upon retirement. However, this advantage should not be overrated. Because if a fund can also be held in private assets, this also means that it is not optimized for pension assets and less withholding tax can be reclaimed. So it is better to change funds once at retirement than to forego a share of the dividends and interest year after year.

Another important thing to consider is the costs that may be incurred by pension funds.