→ Go to the do’s and don’ts of pillar 3a.

Anyone who saves with pillar 3a has probably already noticed: You get practically no interest on 3a accounts anymore. An alternative is to invest your pillar 3a in securities. But what are the characteristics of a good securities solution for pension provision?

High performance and low costs

Performance: The benchmark of all matters

For many investors, the most important thing is high performance. However, when you compare the performance of the various offers, you should keep a few points in mind:

- Only compare funds with each other with a similar high ratio of equities and real estate.

- Compare long-term performance numbers (5- or 10-year returns). Short-term returns indicate little about the quality of an investment fund. It is in the long run that the wheat is separated from the chaff. If a fund swings to the top over 10 years by cost, it appears to be doing something right, whether it invests actively or passively.

- Be sure to compare performance at the same point in time. Factsheets are published at the end of the month. Some are faster in producing the factsheets, for others it takes almost a whole month to get the factsheets for the last month.

The expenses shown in the factsheet (TER) are already deducted from the performance. So when you compare performance, you’ve already indirectly factored in the TER costs.

Additional fees must be taken into account

However, you should note that there may be additional fees (in addition to the fund costs TER). Common ones are issue and redemption commissions or foreign currency margins.

These additional costs are not included in the performance figures of the factsheets. You have to do this on your own.

Reclaiming withholding tax improves performance

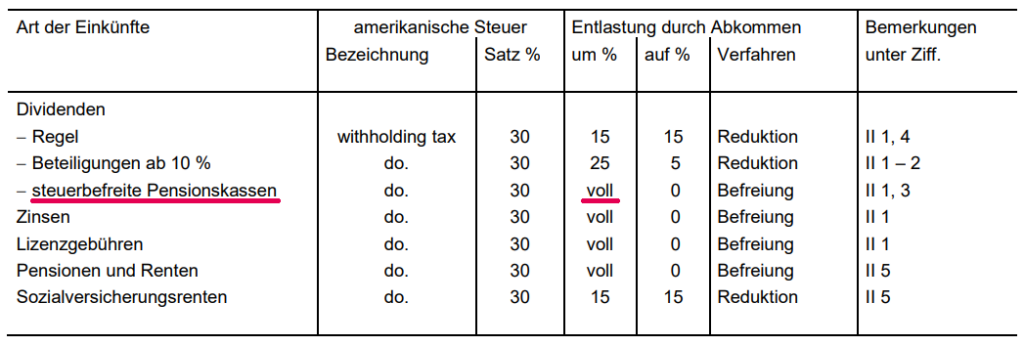

Withholding taxes are deducted on income such as interest or dividends earned abroad (called withholding tax in Switzerland). On dividends from US companies, this withholding tax is 30 %. If you were to receive CHF 100 per share, CHF 30 would go to the treasury in the US.

Funds containing only pension assets can avoid the deduction of withholding tax. They benefit from the agreements Switzerland has concluded with the U.S., among others. Under these agreements, pension funds generally enjoy a special status that exempts them from withholding tax (or allows them to reclaim it, which the fund does for its unit holders).

Extent of relief for pension funds (according to the additional protocol also for the 3rd pillar since January 1, 2020):

This is in complete contrast to ETFs. ETFs are traded on the stock exchange and can be bought by anyone. The fund management therefore has no overview of what kind of money is invested in the fund. Therefore, ETFs can reclaim less withholding tax than pure pension funds.

Reclaiming withholding taxes improves a fund’s performance. In this example, the pension fund outperforms the regular fund by more than 0.5 % per year:

| Title | Category | 1 year | 3 years | 5 years |

| CSIF (CH) III Equity World ex CH – Pension Fund QB | Pension fund | 6.19% | 23.56% | 59.89% |

| CSIF (CH) Equity World ex CH QB | Regular fund | –5.48% | – 22.05% | – 57.02% |

| Adjustment for lower TER costs in Pension Fund QB (0.04 % p.a.) | –0.04% | –0.12% | – 0.20% | |

| Outperformance | Pension fund | 0.67% | 1.39% | 2.67% |

Sustainability criteria

If you place a high value on sustainable corporate governance, it is advisable to include ESG criteria in the assessment in addition to the performance figures. ESG means:

- E = Environment

- S = Social

- G = Governance

No award through the following options

Cash instead of bonds

Cash is not an equivalent substitute for bonds. It is true that bonds sometimes have a negative return, but not everywhere.

The bonds we use in strategies with an equity component of 20 % to 80 % have the following yields to maturity (factsheets as of December 31, 2020):

| Fund name | ISIN | Share in % | Yield to maturity p.a. |

| CSIF (CH) Bond Corporate Global ex CHF Blue ZBH | CH0189956813 | 40 | 1.30% |

| CSIF (CH) Bond Switzerland AAA-BBB Blue ZB | CH0039003055 | 30 | -0.24% |

| CSIF (CH) I Bond Government Global ex CHF Blue ZBH | CH0188772989 | 20 | 0.23% |

| CSIF (CH) Bond Government Emerging Markets USD Blue DBH | CH0259132261 | 10 | 3.78% |

| Total weighted yield to maturity | 0.87% |

Currency hedging costs were not taken into account. However, these are included in the historical performance, which is as follows:

| Fund name | ISIN | Share in % | 1Y | 3Y p.a. | 5Y p.a. |

| CSIF (CH) Bond Corporate Global ex CHF Blue ZBH | CH0189956813 | 40 | 6.6% | 2.3% | 2.7% |

| CSIF (CH) Bond Switzerland AAA-BBB Blue ZB | CH0039003055 | 30 | 0.9% | 1.7% | 1.9% |

| CSIF (CH) I Bond Government Global ex CHF Blue ZBH | CH0188772989 | 20 | 4.4% | 2.0% | 2.1% |

| CSIF (CH) Bond Government Emerging Markets USD Blue DBH | CH0259132261 | 10 | 3.1% | 1.9% | 2.8% |

| Total weighted performancep.a. | 4.1% | 2.0% | 2.4% |

Conclusion:

There is not much left, but there is still some return on bonds. In addition, the investment risk with bond funds is much better diversified (i.e. spread over more counterparties) compared to bank accounts.

Flexible investing

Offers that allow you to buy and sell at any time sound interesting at first glance. However, this is deceptive.

In general, you sell too late and miss the opportunity to get back in as soon as prices rise again. Hitting the right moment has much more to do with luck than with skills.

For many customers, being able to make their own investment decisions is therefore more of a burden than an advantage. If you don’t know anyway, it’s usually better to accept it as it comes.

Change what you can change and accept what you can’t change.

In other words, look for a good securities solution with a good performance and accept the fact that you can never know in advance when the right time comes to invest.

Active trading makes little sense, especially for pension plans. With an investment horizon of 10, 20 or even more years, it doesn’t matter that much at what point you invest exactly. It is probably better to simply be invested.

Time in the market beats timing the market.

In the 3rd pillar, you also have the advantage that you can invest annually, which leads to a natural smoothing of the purchase price.

Of course, before a planned withdrawal, it can make sense to reduce the equity component and thus also the fluctuation risks. Because then you no longer have time to wait for prices to recover.

Transfer to private assets

It is not an award for a pension fund if it can be transferred to free capital.

The opposite is true. If a fund can be transferred to private assets, it also means that this fund is not only for pension assets. And if it is not only for pension assets, it can reclaim less withholding tax on foreign returns than a pure pension fund.

Compared to the underperformance due to the lack of withholding tax reclaim, the cost of selling the pension fund and buying other funds in the free assets is marginal. Especially since you have to consider that you had the underperformance year after year, but the costs for reinvestment are only incurred once at the time of retirement.

The small 1 x 1 of investing

High return = High risk

Anyone who invests money in shares wants to achieve the highest possible return. In order to achieve the highest possible return, you have to invest in funds with the highest possible percentage of shares. But the higher the proportion of shares, the higher the risk of loss.

The best would therefore be to be able to achieve a high performance without having to take higher risks at the same time, for example by buying shares at the right time and selling them again at the right time.

We ask ourselves how this could be possible and whether these two characteristics help to perform better than the others on the stock market:

- Knowledge advantage

- Special skills

Exploiting insider knowledge is illegal

If you know more than others, it can be very interesting.

Example: If someone knows that company X will soon present a better annual result than expected, he or she can buy shares of this company. As soon as the news about the positive result appears, the other market participants are willing to pay more for the company. The share price rises. A profit can be made.

But insider trading has been prohibited for a long time. Therefore, it is no longer possible to know more than others already know, and this also applies to the very big investors.

Special skills are useful in tennis, but not in investing in securities

If you are better than others, you can perform better. But what distinguishes someone who is better than others? What is special about him or her? Anyone can invest in the stock market today. Everyone has free access to the market. All information can be found at any time.

In soccer or tennis, it’s fairly clear. There, special skills help you to play better. Luck also plays a role in whether you have a good day as a tennis player, but in the long run it all comes down to skills, and of course training.

The exact opposite is true when investing in the stock market. Your own skills or those of the fund manager are of little importance. Training is also of little use. It depends much more on luck whether you hit the right entry point or not.

We always find out when this perfect time is, but only afterwards, except for the people with the really «special» skills, of course #IronieOff

Conclusion

You see, despite our best efforts, it is not possible to predict the market movements. Therefore, it remains the same: return and risk are inextricably linked.